- Lemberg Law

- FDCPA – Debt & Credit Complaints

- Debt Collection FAQ’s

- What Can Debt Collectors Do?

Debt collectors can use a host of tactics, including calling you at home and at work, providing their actions do not violate state or federal law.

Debt collectors do’s and don’ts.

In response to abusive debt collection tactics, the U.S. enacted the Fair Debt Collection Practices Act (FDCPA) in 1978 to protect consumers from unfair practices and harassment from debt collectors.

The FDCPA outlines many restrictions regarding when and how a debt collector may attempt to collect a debt from you. It prohibits them from harassing, abusing, or oppressing you, and limits:

- The time of day a collector may call you.

- Their interactions with third parties regarding your debt.

- The frequency and volume of their calls.

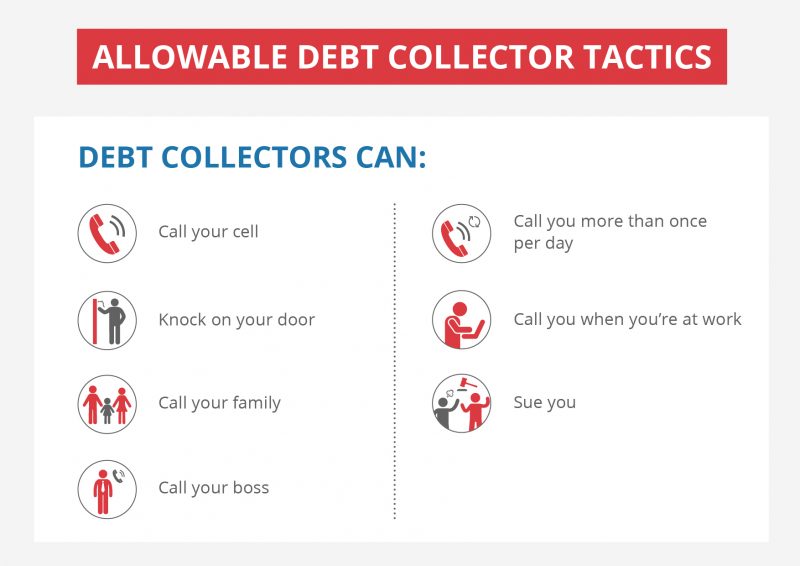

So, what can debt collectors do? Despite the limitations imposed by the FDCPA, there are still several debt collector tactics that are permitted.

Can debt collectors call your cell phone?

Cell phones are treated the same as landlines under the FDCPA, enabling a debt collector to reach you wherever you go throughout the day. Debt collectors can call your cell phone after 8:00 a.m. and before 9:00 p.m. in your time zone. They may not call you repeatedly or continuously to harass you, though, since that is a violation of Section 806 of the FDCPA.

Can debt collectors call you while you’re at work?

Debt collectors can call you on your cell phone or work phone while you are at work. However, they may not call you at work if you have already informed them that work hours are an inconvenient time for you or that your employer has a policy against taking personal calls while you are at work. In Pittman vs. J.J. Mac Intyre Co., Ms. Pittman alleged that she told the debt collector that she could not talk at work, but that the debt collection agency called her again. In Horkey vs. JVDB & Associates, Ms. Horkey told the debt collector that she couldn’t talk at work and asked if she could call him back from home. The debt collector wouldn’t let her get off the phone, and so she hung up on him. Even though a debt collector may, in some circumstance, be allowed to call you at work, they may not reveal to anyone else that they are a debt collector or that you owe a debt. In Ms. Horkey’s case, the collector called back and left a profane message with one of Ms. Horkey’s coworkers. The court found that the debt collector violated several provisions of the FDCPA.

Can debt collectors call you more than once a week?

There is no specific limit on the number of times a debt collector can call you in a week. However, if they call you repeatedly—with excessive frequency under the circumstances—or continuously—making back to back calls—they are in violation of Section 806 of the FDCPA.

Can debt collectors come to your home?

Debt collectors may not come to your place of work, but they are permitted to come knocking on your door at home. However, that rarely happens. The same rules that apply to phone calls apply to house visits. A debt collector may not knock on your door before 8:00 a.m. or after 9:00 p.m. Their visits also may not be construed as harassing, annoying, or abusive.

Can debt collectors call your family members to get your information?

While the FDCPA Section 805(b) has strict rules regulating the way debt collectors can communicate with third parties, Section 804 allows collectors to contact other people in order to obtain your contact information. However, the debt collector cannot say that he is collecting a debt, cannot contact the same person more than once unless asked to do so, and cannot reveal the name of the collection agency unless asked. For example, a collector can call your brother, Henry, to ask for your address. If Henry asks him to call back later that night, the collector may do so. But if Henry tells him to get lost, the collector may not call back.

Can debt collectors call your employer to get information about your location and how to contact you?

The same rules that apply to contact with family members apply to communications with your employer, in that they can ask for your address and phone number. Debt collectors may also contact your employer to verify your employment status, but your employer is not required to provide information about your salary or other details of your employment.

Can debt collectors sue you?

The company to which you owe money can opt to sue you. Typically, the company will use a debt collection agency’s attorneys to file a lawsuit against you. Debt collectors can also call you and tell you that they plan to sue you, as long as they intend to do so and the debt is not past statute of limitations.

If a debt collector falsely indicates that they intend to take immediate legal action and that is not the case, their conduct constitutes a false representation in violation of Section 807 of the FDCPA. Similarly, a debt collector may also not threaten you with a lawsuit in an attempt to harass, annoy, or abuse you. In Bentley vs. Great Lakes Collection Bureau, Ms. Bentley received a debt collection letter saying that the agency would “proceed with whatever legal means necessary to enforce collection,” when the owner of the debt had not authorized the agency to do so. In fact, the agency didn’t even have attorneys licensed to practice in Connecticut, where Ms. Bentley lived.

While there are plenty of tactics that debt collectors can legally employ to try to collect the money you owe, they must comply with the restrictions imposed by the FDCPA or they may face legal consequences. If you believe that your rights as a consumer have been violated by unfair or harassing debt collection activities, contact Lemberg Law’s debt collection harassment team to discuss your legal options. Call us at 475-277-1600 ☎ NOW or complete our online form.

Case citations

Pittman vs. J.J. Mac Intyre Co., 969 F.Supp. 609 (D.Nev. 1997)

Horkey vs. JVDB & Associates, Inc., 333 F. 3d 769 (7th Cir. 2003)

Bentley vs. Great Lakes Collection Bureau, 6 F.3d 60, 62 (2d Cir. 1993)

Have questions? Call us now at 475-277-1600 for a Free Case Evaluation.

Our services are absolutely FREE to you.

The harassing company pays our fees.