- Lemberg Law

- FDCPA – Debt & Credit Complaints

- Debt Collection FAQ’s

- How Long Do Collections Stay on Your Credit Report?

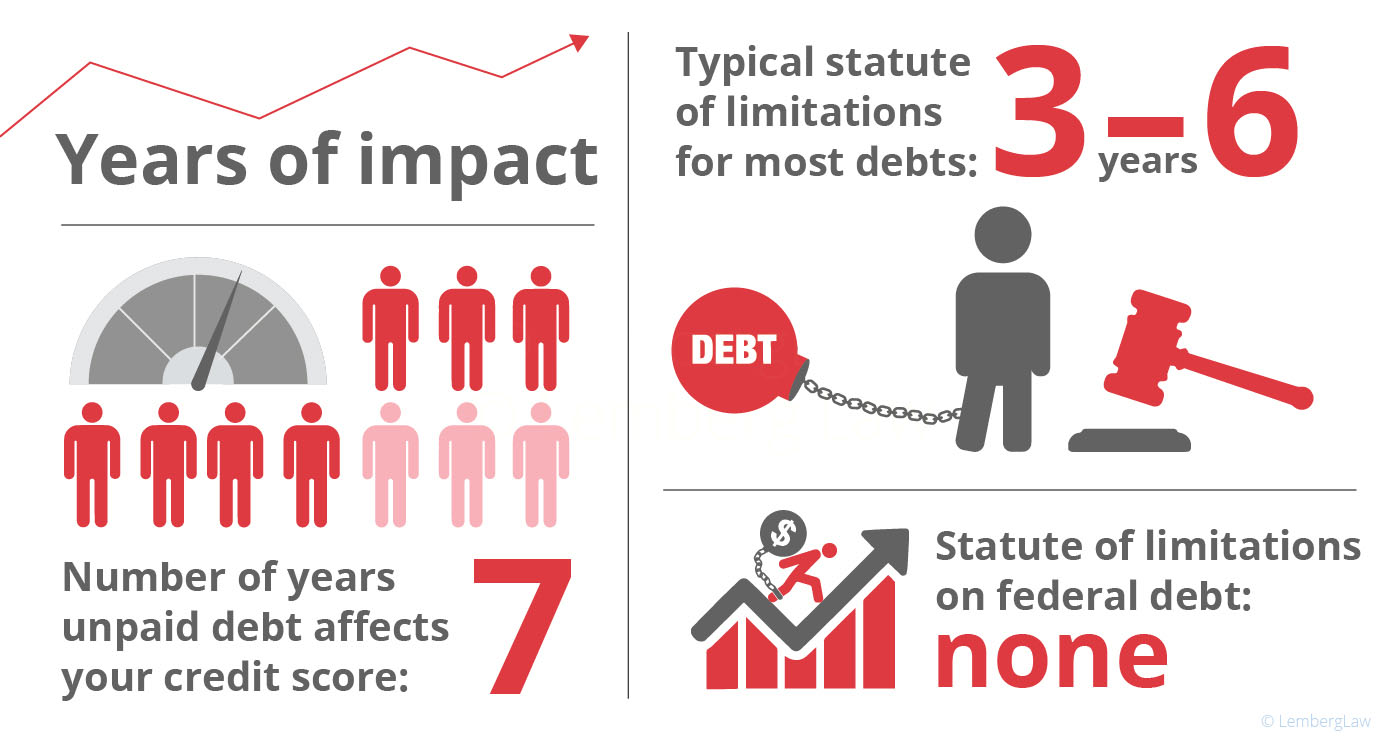

Generally speaking, collection accounts stay on your credit report for 7 years.

Statute of limitations is a law that sets the timeframe in years for a debt collector to sue you, creating what’s often called a time-barred debt. But the terms are not interchangeable, and a time-barred debt depends on state law.

In November 2021, new laws promulgated by the Consumer Financial Protection Bureau (CFPB) defined “statute of limitations” and “time-barred debt” for the first time. Statute of limitations means the time period the applicable law prescribes for bringing legal action against a debtor. A time-barred debt is one where the statute of limitations has expired. What hasn’t changed is that the statute of limitations may be an absolute defense against a tardy debt collector pursuing a time-barred debt. In addition to old debts dropping from your credit report, non-federal debts typically are uncollectible in 3-6 years (see list of states below).

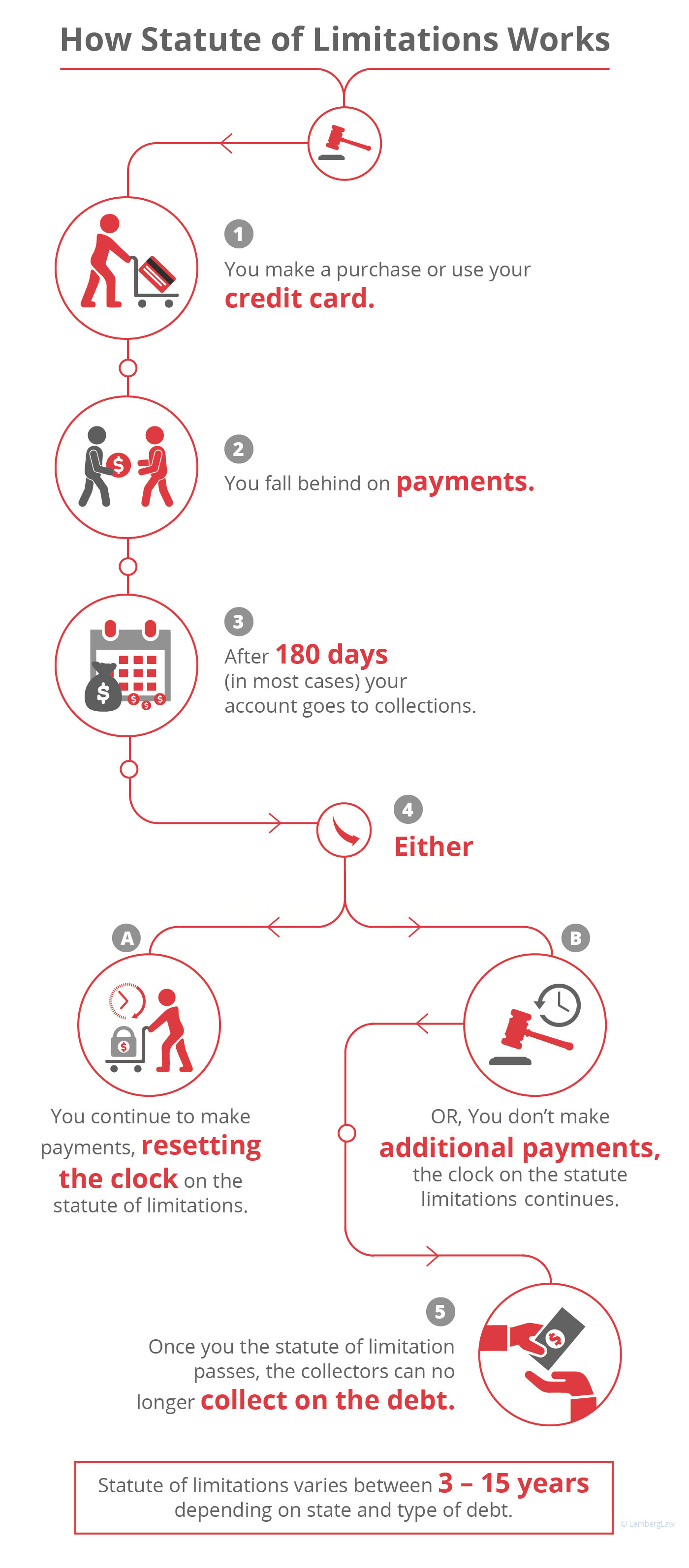

How the Statue of Limitation Works

If you have old debts, here’s how it can work in your case:

However, understand that while this statute may make it impossible to collect the debt, you still owe the debt. The application of the law is often complex. Therefore, it becomes important to talk to an experienced debt collection lawyer if you think that the statute of limitations may apply in your case.

How the Statute of Limitations Protects You From Debt Collectors

The law varies between the states and according to the type of debt. Here’s a list of the states with shorter statutes of limitations:

| States with the Shortest Statutes of Limitations (3 – 6 years) | ||||

| State | Written contracts | Oral contracts | Promissory notes | Open-ended accounts (including credit cards) |

| Alabama | 6 | 6 | 6 | 3 |

| Arizona | 5 | 3 | 6 | 3 |

| Arkansas | 5 | 3 | 3 | 3 |

| California | 4 | 2 | 4 | 4 |

| Colorado | 6 | 6 | 6 | 6 |

| Connecticut | 6 | 3 | 6 | 3 |

| D.C. (Washington) | 3 | 3 | 3 | 3 |

| Florida | 5 | 4 | 5 | 4 |

| Georgia | 6 | 4 | 6 | 4 or 6** |

| Maryland | 3 | 3 | 6 | 6 |

| Massachusetts | 6 | 6 | 6 | 6 |

| Michigan | 6 | 6 | 6 | 6 |

| Mississippi | 3 | 3 | 3 | 3 |

| Nebraska | 5 | 4 | 5 | 4 |

| New Jersey | 6 | 6 | 6 | 6 |

| New York | 6 | 6 | 6 | 6 |

| North Carolina | 3 | 3 | 5 | 3 |

| North Dakota | 6 | 6 | 6 | 6 |

| Oklahoma | 3 | 5 | 5 | 3 |

| Pennsylvania | 4 | 4 | 4 | 4 |

| South Carolina | 3 | 3 | 3 | 3 |

| Texas | 4 | 4 | 4 | 4 |

| Utah | 6 | 4 | 6 | 4 |

** The Georgia Court of Appeals decided in 2008 that the statute of limitations on credit cards is six years rather than the four years set by the Legislature.

And here are states with longer statutes:

| States with Longer Statutes of Limitations (10 or more years) | ||||

| Illinois | 10 | 5 | 10 | 5 |

| Indiana | 10 | 6 | 10 | 6 |

| Missouri | 10 | 5 | 10 | 5 |

| Ohio | 6 | 15 | 15 | 6 |

| West Virginia | 10 | 5 | 6 | 5 |

| Wisconsin | 6 | 6 | 10 | 6 |

How Can I Use the Statute of Limitations Against a Debt Collector?

Do not ignore a lawsuit. A debt collector or a debt buyer will try to collect time-barred debts by suing you. He hopes that you do not come to court allowing him to get a default judgment against you and begin the collection process. You can stop this from happening by taking your lawsuit papers to an experienced debt collector attorney immediately. If your lawyer convinces the judge that your debt is time-barred, your case will be dismissed and you may recover your attorney fees.

When Does the Timeframe Start on the Statute of Limitations for Debt?

The commencement date of the statute of limitations varies between the states. Generally, it begins to run on the date of the last activity of the account. For example, on a credit card debt, the statute would begin to run on the date you last used the card or made your last payment.

Be Careful About Making a Payment.

Debt collectors often try to convince you to make a small payment, especially on an old debt. Your small payment will create a new start date for the statute. You may not want that if you do not plan to pay the debt.

Which State Law Applies to My Case?

This is another complex area of the law. State laws differ. Debt collectors want to use the state with a long statute of limitations. If you signed a contract, the fine print may name the state. If you moved to another state after you signed a contract, there may be a question about which state’s law applies.

Is There a Statute of Limitations for Federal Debts?

Congress eliminated the statute of limitations for federal debts which literally means the federal government could sue you for an unpaid federal debt, such as a federal student loan, at any time during your life.

Does the Statute of Limitations Apply to My Credit Report?

No, the statute of limitations does not apply. The federal Fair Credit Reporting Act (FCRA) regulates the credit reporting agencies. It provides that a consumer reporting agency may not report negative information more than seven years old, or bankruptcies more than 10 years old.

Can a Debt Collector Collect on a Judgment After the Statute of Limitations Applies?

Yes, the debt collector can if he got a judgment against you before the statute of limitations time-barred the debt.

Is It Illegal for a Debt Collector to Try to Collect a Time-barred Debt?

If the debt collector knowingly misrepresented the legal status of your debt to the court by suing you, you may have a claim against the debt collector under the Fair Debt Collection Practices Act (FDCPA). You could be awarded actual damages, statutory damages up to $1,000, court costs, and attorney fees.

Have questions? Call us now at 475-277-1600 for a Free Case Evaluation.

Our services are absolutely FREE to you.

The harassing company pays our fees.