- Lemberg Law

- FDCPA – Debt & Credit Complaints

- Debt Collection FAQ’s

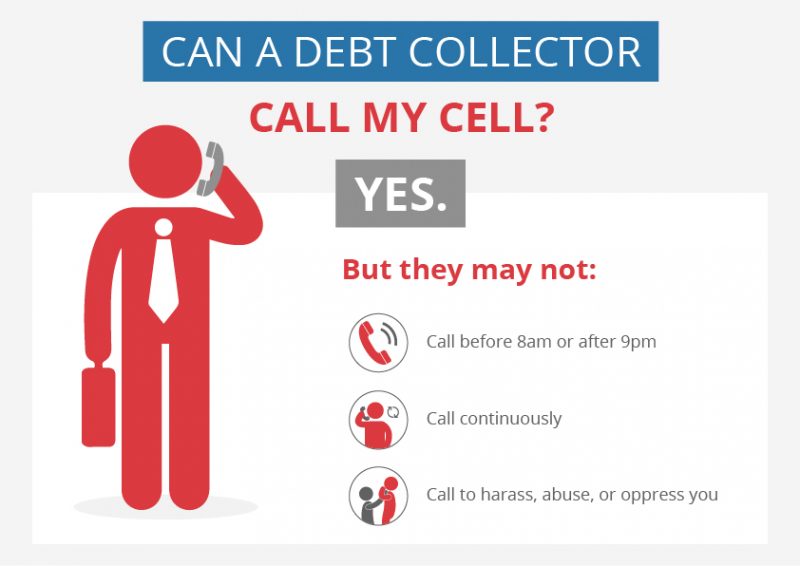

- Can a Debt Collector Call My Cell Phone?

Yes , but they may not call your cell phone repeatedly or continuously, during restricted hours, or after you have informed them to communicate with you in writing only.

Is it legal for a debt collector to call my cell phone?

The 1978 Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from calling you before 8:00 a.m. or after 9:00 p.m. The intent is to prevent collectors from harassing you at a time when you should be able to relax and rest. In the past, this rule effectively limited calls to the period of time between when they returned home from work until 9:00 p.m. However, cell phones now make most people contactable throughout the day, wherever they may be. More than 40 percent of Americans no longer have a landline, so all calls from debt collectors are coming to their cell phones, making them difficult to avoid.

While they may be annoying, cell phone calls from debt collectors are permissible during the allowable timeframe. The same rules apply to cell phones as to landlines. Under the law, debt collectors may not call you repeatedly or continuously to harass, annoy, or abuse you. If you have informed a debt collector that calls at certain times are inconvenient, they may not call you at those times. In Pittman vs. J.J. Mac Intyre Co., the court ruled that the debt collector violated the FDCPA when they called Ms. Pittman at work even after she told them that she could not talk at work.

You may be asking yourself two questions:

- How can I get a debt collector to stop calling my cell phone?

- What should I do if a debt collector will not stop calling my cell phone?

Let’s answer those questions.

How do I get debt collectors to stop calling my cell phone?

The process of getting debt collection calls to stop is the same whether the calls are coming in on your cell phone or on a landline. First, you have no legal obligation to answer your phone or to speak with a debt collector. If you know the call is from a debt collector, suspect it might be, or have no idea who is calling you, you can simply decline the call or let it go to voicemail. You can also inform the debt collector that you no longer want them to call you. From that point on, they must communicate with you in writing only

If you answer your cell phone, you can hang up on the debt collector at any time. A debt collector may not call you back immediately after you have hung up on them. In Chiverton vs. Fed. Fin. Group, Inc., the debt collection agency repeatedly called Mr. Chiverton at work even though he told them he wasn’t allowed to take personal calls at work. When Mr. Chiverton hung up on the debt collector, the debt collector called back within a minute. This happened three more times, for a total of five calls in about as many minutes. The court ruled that this was a violation of Sections 805 and 806 of the FDCPA.

Can a debt collector leave a message on my cell phone?

A debt collector that leaves you any voicemail message must identify themselves as collector and they must state in the message that they are attempting to collect a debt. This is sometimes called the mini Miranda and they have to leave that on any message to you otherwise they have violated the law.

What should I do if a debt collector will not stop calling my cell phone?

If you have already requested a debt collector stop calling and they continue to call you, they are in violation of the FDCPA. You should contact a fair debt attorney and assert your rights under the law.

You can also send the debt collection agency a cease and desist letter, informing the debt collection agency that they may no longer contact you at all. This should stop all communications – both on the phone and in writing – but it does not mean that your debt will go away. Once you send them a cease and desist letter, the debt collector may only contact you again to tell you that they will no longer be contacting you or to inform you that they are filing a lawsuit against you.

Case citations

Pittman vs. J.J. Mac Intyre Co., 969 F.Supp. 609 (D.Nev. 1997)

Chiverton vs. Fed. Fin. Group, Inc., 399 F. Supp. 2d 96, (D. Conn. Sept. 30, 2005)

Have questions? Call us now at 475-277-1600 for a Free Case Evaluation.

Our services are absolutely FREE to you.

The harassing company pays our fees.