- Lemberg Law

- FDCPA – Debt & Credit Complaints

- Debt Collection FAQ’s

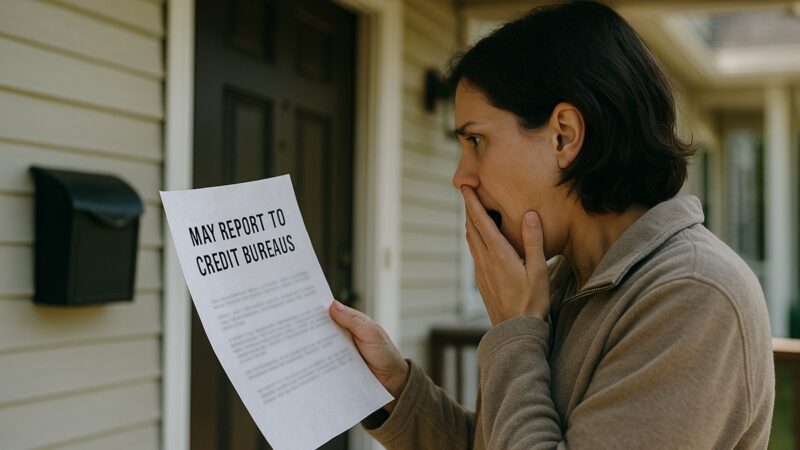

- How Long Before a Collection Agency Can Report to a Credit Reporting Company??

An original creditor can report a delinquent payment when it is 31 days late. Third-party collection agencies, including debt buyers, must take certain steps before they can report debts to credit reporting companies and credit bureaus.

The Consumer Financial Protection Bureau’s (CFPB) Debt Collection Rule, introduced on November 30, 2021, specifies the steps debt collectors and debt buyers must take before they can report debts. Once they have followed the rules relating to making contact with you, they can legally report the debt to companies that deal with credit reports.

What are Debt Collection Agencies vs Credit Reporting Companies?

If you have a debt in collection, you are sure to want to know who you are dealing with.

Collection agencies and lawyers who regularly collect debts that are owed to others are categorized by the CFPB as debt collectors. So too are companies that buy past-due debts from other businesses or original, first-party creditors. They are also known as debt buyers and debt collection companies.

Credit reporting companies are businesses that compile and sell credit reports. They are also known as credit bureaus and consumer reporting agencies. The three main credit bureaus are Experian, TransUnion, and Equifax.

What Steps Must Collection Agencies Take Before They Report Debts?

Debt collection agencies cannot report a debt to a credit reporting company or credit bureau until they have spoken to you and/or communicated with you in writing. Their choice is to:

- Discuss the debt with you in person.

- Talk to you about the debt by telephone.

- Mail a letter about the debt.

- Send an email or other electronic communication about the debt.

If collection agencies opt to put the information in writing, they must wait a reasonable length of time (usually about 14 days) in case they receive a notification that the letter or electronic message wasn’t delivered.

If a collection agency sends you a debt collection validation notice that contains all the required information about the debt, unless you dispute the debt, they can begin the reporting process after the requisite 30 days.

When does collection show on credit report?

Your credit report impacts virtually every aspect of your life. It can determine whether or not you’re able to obtain credit – for a car loan or a Visa card – as well as the interest rate that you’re offered. If you have poor credit, you will pay a considerably higher interest rate than if you have good credit. The strength of your credit can also influence whether or not your apartment rental application is accepted, whether or not you’re offered the job for which you’ve applied, and whether or not you land a promotion. That’s why every line on your credit report matters.

There have always been three primary ways that debts are reported to credit bureaus:

- By the original creditor.

- By the third-party debt collection agency.

- By the debt buyer.

So far, the new Debt Collection Rule does not affect the way first-party creditors report debts. But it does affect third-party debt collection agencies and debt buyers, who are now bound by the same debt-reporting rules explained in the previous section.

The credit reporting life cycle

When you open a line of credit, it’s added to your credit report as what’s called a “trade line.” Creditors may report to the three major credit bureaus (Experian, TransUnion, and Equifax) each month like clockwork, they may send reports intermittently, or they may only report if you make a late payment. If your payment is 31 days late, a creditor may report the skipped payment to the credit bureau.

Typically, there’s a certain period of time during which an original creditor will use its own employees and resources to continue to try and collect on a debt. While the time period varies, it’s standard for businesses to try and collect in-house for 60, 90, 120, or 180 days. After that point, the company “charges off” the debt, and may turn the debt over to a debt collection agency. On your credit report, the trade line from that creditor will be reported as “charged off.”

Once the debt collection agency has your account, your debt can be reported in a separate section of your credit report, the public records and collection section. If the third-party collection agency doesn’t succeed in collecting the debt, then the original creditor may sell your debt to a debt buyer. A debt buyer may purchase thousands (or hundreds of thousands) of accounts for pennies on the dollar. Once a debt buyer purchases the debt, it can again be reported in the trade line section of your credit report.

How long do collections stay on your credit report?

The federal Fair Credit Reporting Act (FCRA) regulates how long various types of items can stay on your credit report. The FCRA (15 U.S.C. 1681c) says that accounts in collection can’t stay on your credit report for more than seven years. That seven years begins 180 days after the account is charged off or placed in collection. This means that a credit report’s “Date of Last Activity” is crucial in determining whether or not collection efforts remain on your credit report.

In Gillespie vs. Equifax Information Services, Ms. Gillespie argued that Equifax’s calculations benefitted debt collectors rather than consumers, since the “last activity” was determined by the collector’s report. The appellate court overturned the lower court’s ruling that favored Equifax, writing, “The Date of Last Activity that previously listed the date of delinquency in the account will be replaced should the consumer make an intervening payment on the account. The date of the intervening payment would become the new Date of Last Activity used in the seven and one-half year calculation. However, the negative credit history relating to the prior delinquency would presumably remain within the consumer’s credit file despite the fact that the consumer faces a new seven and one-half year period before the information is removed from her file.”

The important takeaway is that, if a debt has been on your credit report for six years and then you make a payment, that payment can be reported and the debt will show up for another seven years.

Removing collection agency reports from your credit report

If you are able to either pay off a debt or negotiate a debt settlement, it’s in your best interest to make payment contingent upon the debt collection agency deleting the item from your credit report. A “debt settled” notation can be damaging to your credit, so having the item removed or having it marked “paid in full” is the best possible strategy. Because there is a high turnover of personnel in debt collection agencies, make sure to get any agreement about how the payment or settlement is reported in writing. This will protect your rights under the FCRA.

If a debt collector or a credit bureau violates the FCRA, you are entitled to file suit against them. If they are found to have violated the law, you are entitled to actual damages, statutory damages of between $100 and $1,000, and court costs and attorney fees.

If debt collectors have misreported items on your credit report, Lemberg Law has a team devoted to representing people just like you. Call and set up a free consultation at 844-685-9200 or submit the online form.

Case citation

Gillespie vs. Equifax Information Services 484 F.3d 938 (7th Cir. 2007)

Have questions? Call us now at 855-301-2100 for a Free Case Evaluation.

Our services are absolutely FREE to you.

The harassing company pays our fees.

I paid off a few credit cards off that were in delinquent status directlybto the companies I had the debt with. When we made the arrangements, I specifically asked them if they would remove the credit report negative remark by our arrangement, and they had all said yes. To this day, they haven’t. And when I submitted a dispute, it came back as there not needing any changes because the information was all “correct.” What can I do?

I sent a debt validation letter to hunter warfield, not only did they not respond or acknowledge, they continue to call my cell number even though I have asked them not to call. They are also charging interest on the balance they claim I own. I paid all my rent and there were no damage in the apartment I left 2+ years ago. I want to know if I have legal recourse?