- Lemberg Law

- What is the The Fair Labor Standards Act?

- Overtime Pay Lawyer

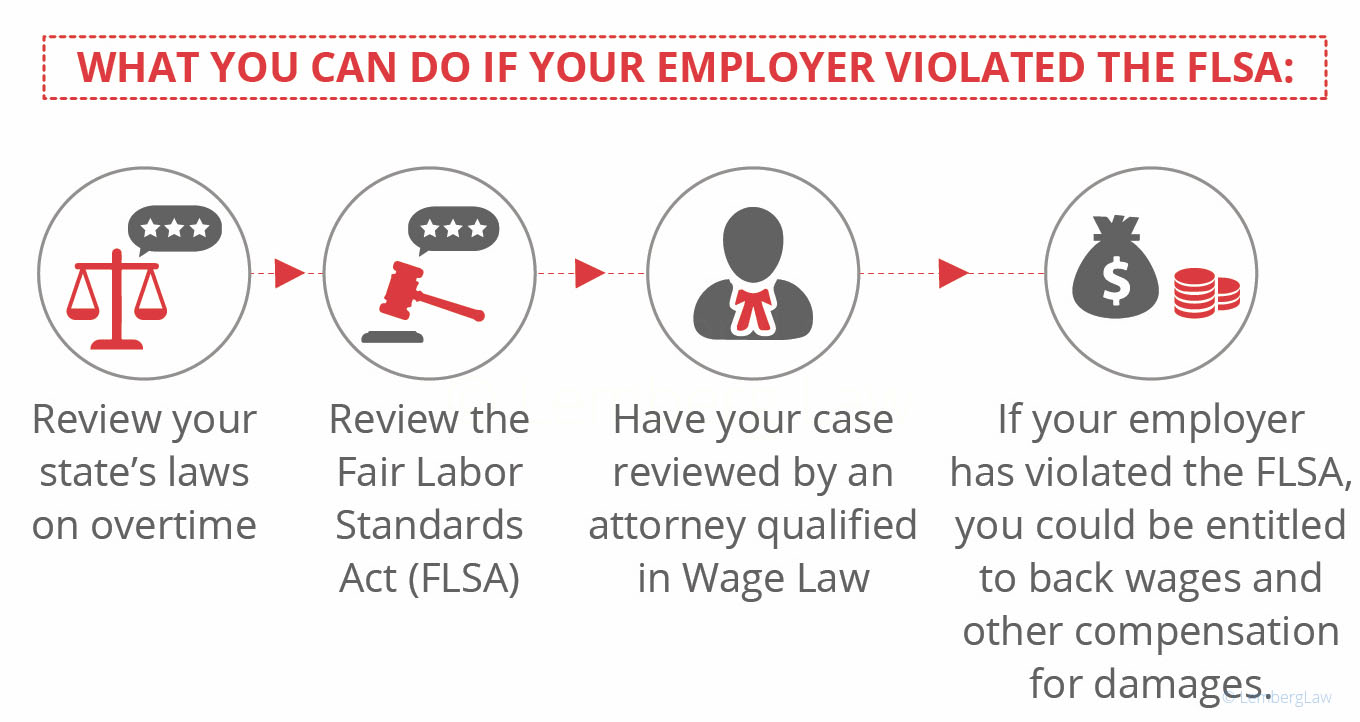

If your employer has not given you overtime pay you were entitled to or if you have another wage theft problem, contact our lawyers. Our skilled employment law attorneys have been providing excellent legal service to thousands of workers like you in 29 states for more than 12 years.

Victim of Wage Theft? Hire An Experienced Overtime Pay Lawyer

Our attorneys understand how to use federal and state laws to recover wages stolen from you by your employer. Employer “wage theft” includes manipulating your hours to not pay you minimum wage, ignoring off-the-clock hours to avoid paying overtime, and misclassifying you as an overtime-exempt worker.

Worker protection laws allow you, either alone or as part of a class or collective lawsuit, sue your employer for lost wages. Our attorneys have helped our clients successfully recover stolen wages after filing a lawsuit.

Unpaid Overtime Wage Theft Victims Often Work in These Industries

The U.S. Department of Labor’s Wage and Hour Division, which enforces federal wage laws, lists these as top wage-theft industries:

- Nursing

- Casinos

- Homecare

- Nannies or Childcare

- Restaurants

- IT Workers

- Construction

- Retail

- Oil and Gas Field Services

- Security Guard Services

- Call Centers

Regardless of where you work, if you think your employer is cheating you out of your overtime pay or engaging in other wage theft, have a qualified worker employment lawyer review your case.

We Expertly Represent Clients Owed Unpaid Overtime

Employers use many illegal tactics to avoid paying you the overtime that you earned. In some instances, you may be earning less than minimum wage if you are not paid for overtime hours. For example, if your weekly pay is $290 for 40 hours, you earn the federal minimum wage of $7.25 per hour. However, if your weekly pay is $290 for a 40-hour week and 5 hours of overtime, you earn only $6.44 per hour. Failure to pay you overtime violates federal law.

How much could that be? You should be paid time and a half for overtime hours. In this example, you are owed $11.75 per hour which is an additional $56.25 per week. Your employer should have paid you $346.25 for that week.

If you regularly work more than 40 hours per week without getting overtime pay, your employer owes you a significant amount of money. You are entitled to collect all unpaid overtime from your employer. Lawyers at Lemberg Law know how to help you get the money that rightfully belongs to you.

Here are common tricks used by employers to avoid paying you overtime wages.

They don’t count the time you spend working “off the clock”.

As examples, your employer may require you to do prep work before you clock in, or answer phone calls while you are on your lunch break, or clean your work area after you punch out. By law, your employer must pay you for time spent doing work for your employer’s benefit whether you are at your place of employment, on the road, or at your home.

Your employer must keep accurate records of all your time and include off the clock hours in calculating your overtime.

They average your weekly hours rather calculating overtime one week at a time.

The law requires your employer to calculate your overtime one week at a time. For example, say you worked 50 hours in week one and 30 hours in week two. You should receive ten hours of overtime pay for week one. You employer tries to avoid paying overtime by averaging the two weeks and claiming that your worked 40 hours each week. This particularly happens if you are paid every two weeks.

They misclassify you as a salaried worker.

If your regular weekly pay is less than $455, under federal law you are classified as an hourly worker and are entitled to overtime pay. Employees earning more than $455 are considered salaried employees exempt from overtime pay regulations. Some employers wrongfully classify hourly workers as exempt salaried workers to avoid paying overtime.

They consider you to be an independent contractor.

Employers have certain obligations to their employees, including paying a minimum wage and paying overtime to their hourly workers. Employers have no such obligation to independent contractors who are not protected by federal law.

If you have been misclassified as an independent contractor, you may have a claim against your employer for unpaid overtime pay.

They pressure you into taking comp time off instead of overtime pay.

Private employers who give hourly workers compensatory time off rather than paying overtime wages violate federal law. Only certain state and federal workers, such as first responders, can legally be compensated for extra hours with comp time. If your employer gives you comp time, by law it still owes you overtime pay.

See our Overtime Pay Checklist here

Can My Employer Retaliate if I Sue to Recover Unpaid Overtime?

Although your employer breaks the law by retaliating, it does happen. You may be demoted, giving unfair and inaccurate performance reviews, or suffer reduced your hours. If this happens, you can file a separate suit for reinstatement, actual damages and, possibly, punitive damages.

If I Sue for Wage Theft, What Can I Win?

Federal laws provide that an employee may recover liquidated damages equal to twice the unpaid back wages, actual costs of litigation, and attorney fees. State laws vary and may provide for additional damages.

Who pays for my Overtime Pay Lawyer Fees?

We charge a fee only if you win. This is called a contingency fee and is based on a percentage of the settlement or verdict. We reach a written fee agreement with each client at the beginning of each case.

Unpaid Overtime is Only One Form of Wage Theft

We represent worker damaged by all forms of wage theft such as illegal tip pools, illegal deductions from your pay, and illegal withholding of final pay on termination. We represent the immigrants, the undereducated, the young, and the women who most likely to become victims of unscrupulous employers. Many states have tough laws to protect workers and punish irresponsible employers. Major cities including Berkeley, California, Miami, Philadelphia, and Seattle have passed city ordinances. The Wage Theft Prevention and Wage Recovery Act was introduced in Congress in 2017 but has not become law.

At Lemberg Law, we keep up with all new laws to provide our clients with the most accurate advice.

We handle Overtime Pay Cases, Unpaid Wage and Wage Theft Claims in these States

We represent victims of unpaid overtime and other forms of wage theft in 29 states:

Alabama

Missouri

North Dakota

Washington DC

If you believe you’re owed overtime pay, unpaid wages or are a victim of wage theft call Lemberg Law at 475-277-2200 now for a free, no-obligation case evaluation. We’re standing by to take your call.

I have concerns about the legality of my pay and have no idea where to start. My friend sent me a link to this page when I quit my job at subway. I was labeled as an assistant manager but there was no store manager, the only people higher in power in front of me was a general manager and then the owner. I was only paid $9.25 after asking for a raise, before hand I was only making $9. Also I have multiple pay stubs with over 40 hours in a week with no over time, meaning I never received overtime. Until the last time I didnt get my over time and confronted my boss, they pulled the money out of the cash register and did it as a paid out.

I just viewed your advertisement on television. I heard something I am curious about, you mentioned that if we were forced to work overtime even if we were on Salary, then we may be able to compensation. The job I just left last week, forced me to work 9.5 hours a day, paid no overtime because I was on salary.

I was paid under the table 5k to keep quiet about not being paid overtime. They did not look past one year… I was employed with them for over 5 years. I need help getting a review into the rest of my owed OT, as well, they did not pay anyone else anything and I know as the most recent General Manager that over half of my staff must be owed as well.

They have since terminated me after I gave notice of my departure for may 20.

Hello, I work for an insurance call center. At a previous job whenever commission was made they factored into our overtime rate so instead of being just the normal one and a half times they include all of our commissions to be factored in on overtime payments. Here however they never factor any of our comission into our overtime, and only pay us the normal 1 1/2 rate and that is it. After doing some digging through the federal labor law I noticed that all commissions should be factored into overtime pay. Is this correct? Should I be getting more overtime pay? If so I will like to proceed with legal action to get accurate pay.