- Lemberg Law

- FDCPA – Debt & Credit Complaints

- Debt Collection FAQ’s

- Can a Debt Collector Contact Me On Social Media?

Debt collectors and collection agencies have been using social media to gather personal information for years. But since the introduction of the Consumer Financial Protection Bureau’s Debt Collection Rule on 30 November 2021, there are now mandatory restrictions.

Social media provides a quick, easy method of communication, and now debt collectors can message you legally on social media. But they must follow the relevant rules, including identifying themselves.

Can a Debt Collector Contact Me About a Debt on Social Media?

Debt collectors, including collection agencies and lawyers, must follow strict rules if they contact debtors on social media.

- They must reveal the fact that they are a debt collector when adding you as a contact or asking to be your friend.

- All messages must be private. It’s illegal to post messages that friends, followers, or contacts in general can read.

- They must give you a simple way to opt out of future communications on that social media platform.

There are also very basic rules you, personally, should follow when operating on social media. For instance, it is never a good idea to become friends with people you don’t know, even if you’re trying to build up a huge following. It’s also highly inadvisable to share any kind of personal financial information, good or bad, on any social media platforms.

Debt Collectors May Be Mining Your Social Media Accounts

There is lots of evidence of debt collectors using social media to name and shame debtors over the years.

For example, a debt collector used a Florida woman’s Facebook account to attempt to collect a $362 debt. According to reports, the agency repeatedly sent messages to her and her family requesting that she call about the debt. The woman sued the agency, claiming she had been harassed and that her right to privacy had been violated. The judge ordered the agency to stop contacting the woman’s family and friends on Facebook.

In another case, a Chicago man befriends a woman in a bikini on his Facebook account. The man later learned his new “friend” was, in fact, a debt collector who subsequently posted this message on his Facebook wall: “Pay your debts, you deadbeat.”

While the CFPB’s 2021 Debt Collection Rule affects the rights of debt collectors to mine your social media accounts, you need to be aware of how the debt collection industry works.

According to a US News report, one debt collection executive described the details easily obtained on public internet sites and social media as a “billboard” of useful information. For example, a debt collector seeking to garnish wages might find a Facebook post about a new job, then check the debtor’s LinkedIn listing to work out the employer.

There is nothing illegal about debt collectors using these open information sources, but there are limits, as illustrated by the Florida court’s order in the case mentioned above.

Bill Bartmann, CEO of Oklahoma-based debt collection company CFS II, gave the following example, quoted in the same report, of collection tactics which the Federal Trade Commission would likely find impermissible:

“If I were to be a bit surreptitious and if I were to actually try to become your friend on Facebook and you were to accept me as a friend on Facebook, I would get access to all kinds of really, really good information on you.”

Nothing much has changed, except that the CFPB’s Debt Collection Rule makes it more difficult to mine social media information. As shown above, it also spells out the legalities of using social media to contact debtors.

The Federal Trade Commission Is Monitoring Debt Collectors’ Use of Social Media

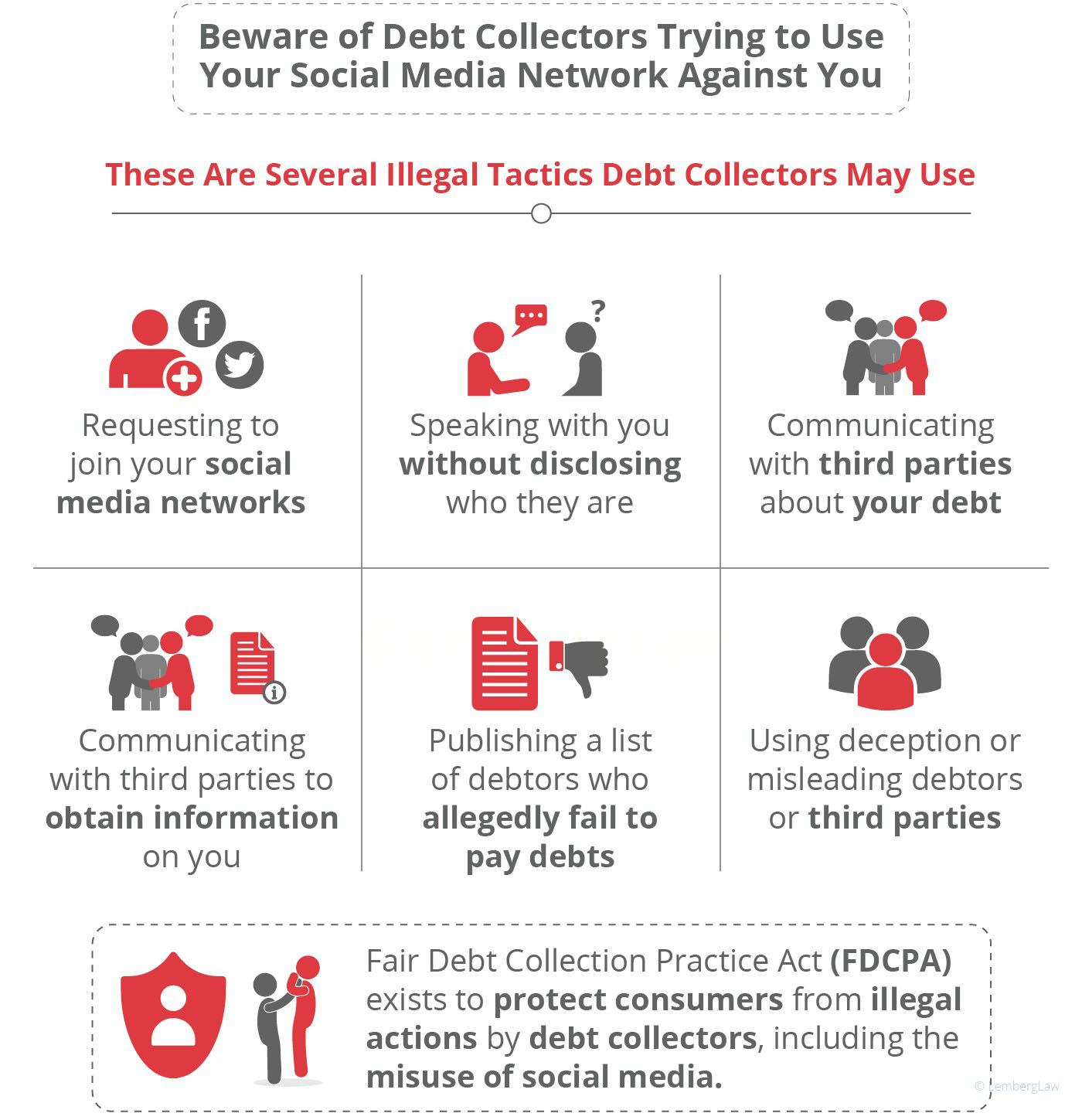

In addition to the new Debt Collection Rule, the Federal Trade Commission (FTC) also uses federal laws set down in the Fair Debt Collection Practice Act (FDCPA) to protect consumers from illegal actions by debt collectors, including the misuse of social media.

“The FTC is keeping a close eye on the use of social media and emerging technology in the collection of debt,” says Christopher Koegel, staff attorney at the commission. “We’ve been monitoring the area for several years.”

According to the FTC, a debt collector communicating with a debtor may violate the law by using social media to:

- Request to join a debtor’s social media networks

- Initiate subsequent communications without making the disclosures required by law

- Communicate with third parties, such as friends and family, other than in certain permitted circumstances

- Communicate with third parties to obtain information about the debtor in a manner that violates the law

- Publish a list of debtors who allegedly fail to pay debts

- Communicate with debtors or third parties in a false, deceptive, or misleading way

The CFPB’s new Debt Collection Rule clarifies exactly which actions are violations.

Behind on a Payment? Here are Six Common Sense Steps to Protect Your Social Media Accounts From Illegal Debt Collector Tactics

- Assume that your debt will be turned over to a debt collector

- Assume the debt collector is watching your social media posts

- Do not post your employment, location, contact or financial information online

- Educate yourself about your legal rights. The law requires that a debt collector:

- Reveal their identity. He/she must identify themselves and explain they are attempting to collect a debt.

- Limit their contacts. A debt collector may only contact you, your attorney, any co-signers, and your spouse.

- Provide you with a written notice. A debt collector must provide you with a written notice of the debt owed within five days.

- Honor your request not to be contacted at work. A debt collector can never threaten to tell people about your debt or threaten your job.

- Honor your request not be contacted. You can only be contacted by the debt collector again if the creditor is taking you to court.

- Save any and all communications from debt collectors until the matter is resolved. You may need them as evidence.

- If you suspect your rights have been violated, contact a consumer attorney.

Behind on a Payment?

If a debt collector has been hounding you, call 475-277-1600 now for a free, no-obligation case evaluation with one of our representatives. The attorneys at Lemberg Law have experience fighting debt buyers and standing up for consumers. If a debt buyer has violated the Fair Debt Collection Practices Act, you’re entitled to file suit in federal court and could be awarded up to $1,000.