- Lemberg Law

- FDCPA – Debt & Credit Complaints

- Debt Collection FAQ’s

- When to Tell Deceased Debt Collectors That You Refuse to Pay Relatives Debts

The laws will determine how the decedent’s debts get paid, but they will not stop death-debt collectors from attempting to collect from you while you freshly grieve the death of a relative, most often your spouse. While your emotions control your decision-making, they seek your agreement to pay. Tell them “no”. The laws of your state will determine whether you must pay for the debts of a deceased relative, and federal and state laws will protect you from death-debt collector harassment.

Who is responsible for a deceased person’s debt?

According to the Federal Trade Commission (FTC), you may be liable:

- If you co-signed the obligation, such as a personal loan

- If you live in one of the community property states of Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. Alaska is an opt-in community property state that gives both parties the option to make their property community property.

- If you are the deceased person’s spouse and state law requires you to pay a debt, like some health care expenses. For example, you may have co-signed the agreement to pay hospital bills at the time of admission.

- If you were legally responsible for resolving the estate and didn’t comply with certain state probate laws. This is very unusual.

If none of these exceptions apply to you, the debt is not yours and you need not pay it. If any of these exceptions apply to you, seek the advice of a lawyer. If you are obligated to pay, please review the bills for accuracy before paying.

If I Do Not Pay, Who Will Pay the Debt-Death Collector My Deceased Relative’s Debts?

Perhaps no one. State law will decide, but the debts won’t be paid if the decedent’s estate lacked money. In a consumer bulletin, the AARP states that “No one has an obligation to pay the debts of a deceased person who was not their spouse.”

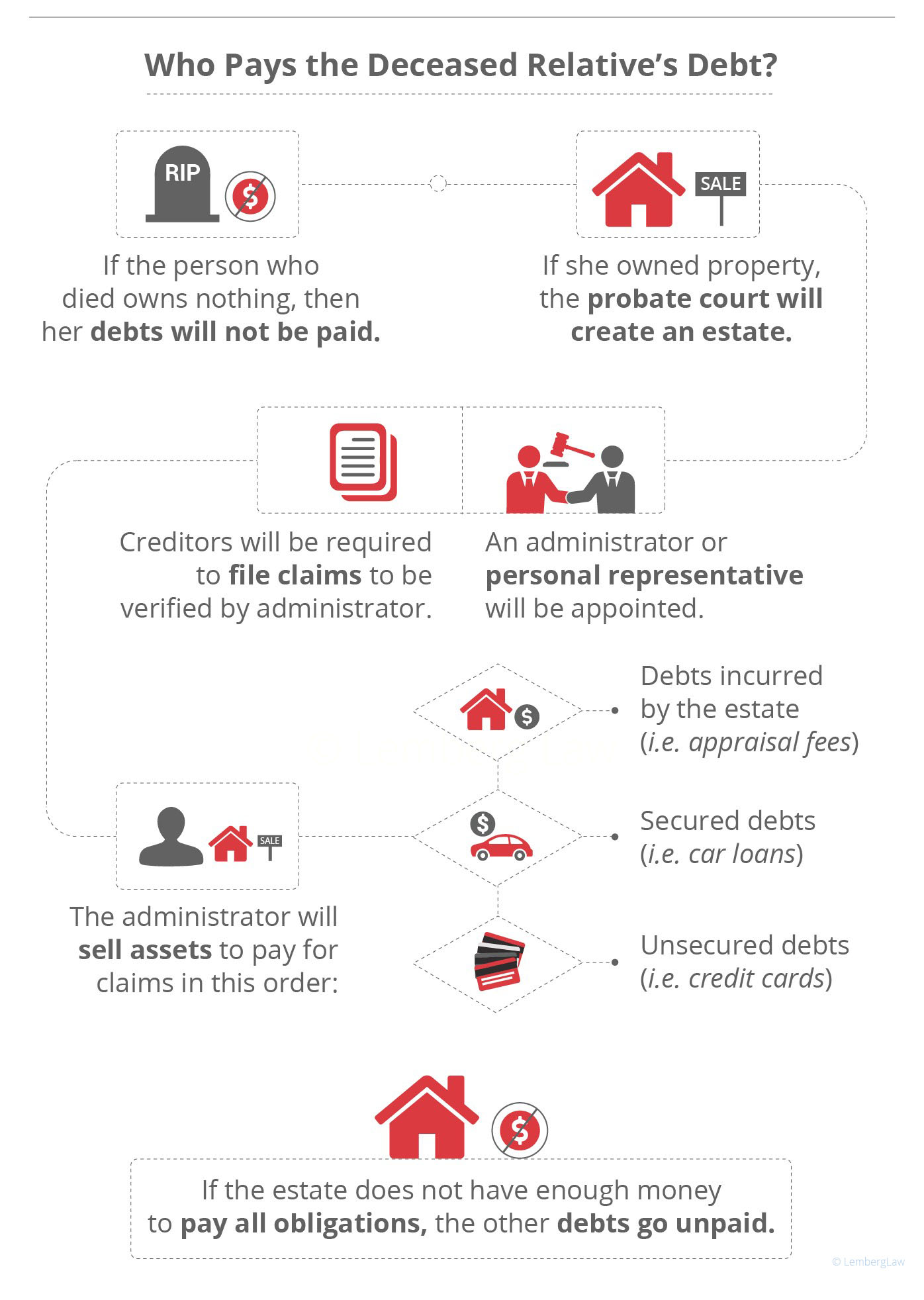

Although the process varies from state-to-state, generally it works like this:

- If the person who died owns nothing, then her debts will not be paid.

- If she owned property, an estate will be created by the probate court.

- An administrator or personal representative will be appointed. Creditors will be required to file claims to be verified by the administrator.

- The administrator will sell assets and pay claims out of the proceeds in this order: Debts incurred by the estate such as appraisal fees, secured debts such as car loans, and unsecured debts such as credit cards.

- If the estate does not have enough money to pay all obligations, the other debts go unpaid. No relative, including you, is obligated to pay them.

What Happens to a Spouse’s Debt After Death?

What Can I Do? My Deceased Relative’s Estate Has No Money, But the Death-Debt Collectors Keep Calling Me.

Congress passed the Federal Debt Collection Protection Act 40 years ago to protect consumers like you from harassment by debt collectors.

According to federal Consumer Finance Protection, Bureau (FCRB), which enforces the FDCPA. some examples of harassment are:

- Repetitious phone calls, including robocalls, that are intended to annoy, abuse, or harass you or any person answering the phone

- Obscene or profane language

- Threats of violence or harm

- Publishing lists of people who refuse to pay their debts (this does not include reporting information to a credit reporting company)

- Calling you without telling you who they are

You can stop death-debt collectors from contacting you by sending them a letter. The CFPB has a sample letter and instructions here.

The CFPB also summarizes consumer harassment complaints about death-debt collectors that repeatedly attempt to collect the debts of the dead after relatives have told them that no estate money exists and that they are not personally responsible for the debts; attempt to collect on old debts after probate has concluded, and ignore “do not contact” letters.

Death-debt collectors break the law by harassing you. The FDCPA gives you the right to sue them for damages. If you want to sue the debt collector for your injuries, you must have a consumer protection attorney represent you. You may be entitled to the following monetary remedies:

- Physical distress caused by the debt collector’s illegal action

- Emotional distress caused by the debt collector’s illegal action

- Lost Wages

- Wage garnishment recovery

- $1,000 in statutory damages

- Punitive damages

- Payment of your attorney fees and costs

Have questions? Call us now at 475-277-1600 for a Free Case Evaluation.

Our services are absolutely FREE to you.

The harassing company pays our fees.

Husband death we had a quit claim with survival to pass directly to me. He left no will. I took death certificate and had another quit claim in my name with survival to my daughter. He had $20000.00 of uninsured debt. If the deed transfer at time of his death does he still have an estate that includes the house. Did not set up probate. Am I responsible for paying these debts?

My husband died Jan 21 2020. The only things in his name at time of death was mortgage and car. No

stocks or bonds. I traded his car and my car for one car in my name only. The house was refinanced in

my Name only. His credit card debt collectors want me to pay because I am the authorized representative of the estate. I think their are no assets to pay the debt from. Am I right?