- Lemberg Law

- What is the Telephone Consumers Protection Act?

- How To Stop Robocalls

Robocalls are an epic nuisance, and they’ve become an epidemic. According to the YouMail Robocall Index, Americans received 5.1 billion robocalls in October 2018. They are annoying and disruptive and can be dangerous for motorists. If you are looking for ways on how to stop them, we have some answers for you.

The TCPA is on Your Side

If you’ve heard about the Telephone Consumer Protection Act (TPCA), you know you’re protected from receiving unwanted calls from automatic dialing systems, artificial or prerecorded voice messages, and SMS text messages.

The most important point to understand about the TCPA, is that it protects consumers who are being contacted WITHOUT CONSENT. The law was amended in 2013 to require prior express written consent for all autodialed or prerecorded calls/texts to wireless cell phones and the same for prerecorded calls to residential numbers.

What is prior express written consent?

It depends on context. For telemarketing (sales) purposes, it means that if a company is making these calls to you they must have a clear written agreement with your handwritten or e-signature. The caller then has the “Burden of Proof”, meaning if a case is made against them they’re responsible for providing proof of consent to contact you. For a bank or other type of creditor, it means that you provided the number to them as part of the original loan application.

According to the FCC, you can revoke consent at any time through any reasonable means. In addition, the caller cannot limit the method for withdrawal of consent. You can take back consent simply by calling, or you can go a step further and revoke your consent in writing via certified mail. In some cases email or fax can be used as a means of revoking your consent. However you do it, be sure to retain proof that consent was withdrawn. Consent can also be revoked orally. Please, keep in mind that this does not prevent them from calling or texting you using the old fashioned ‘manual’ methods.

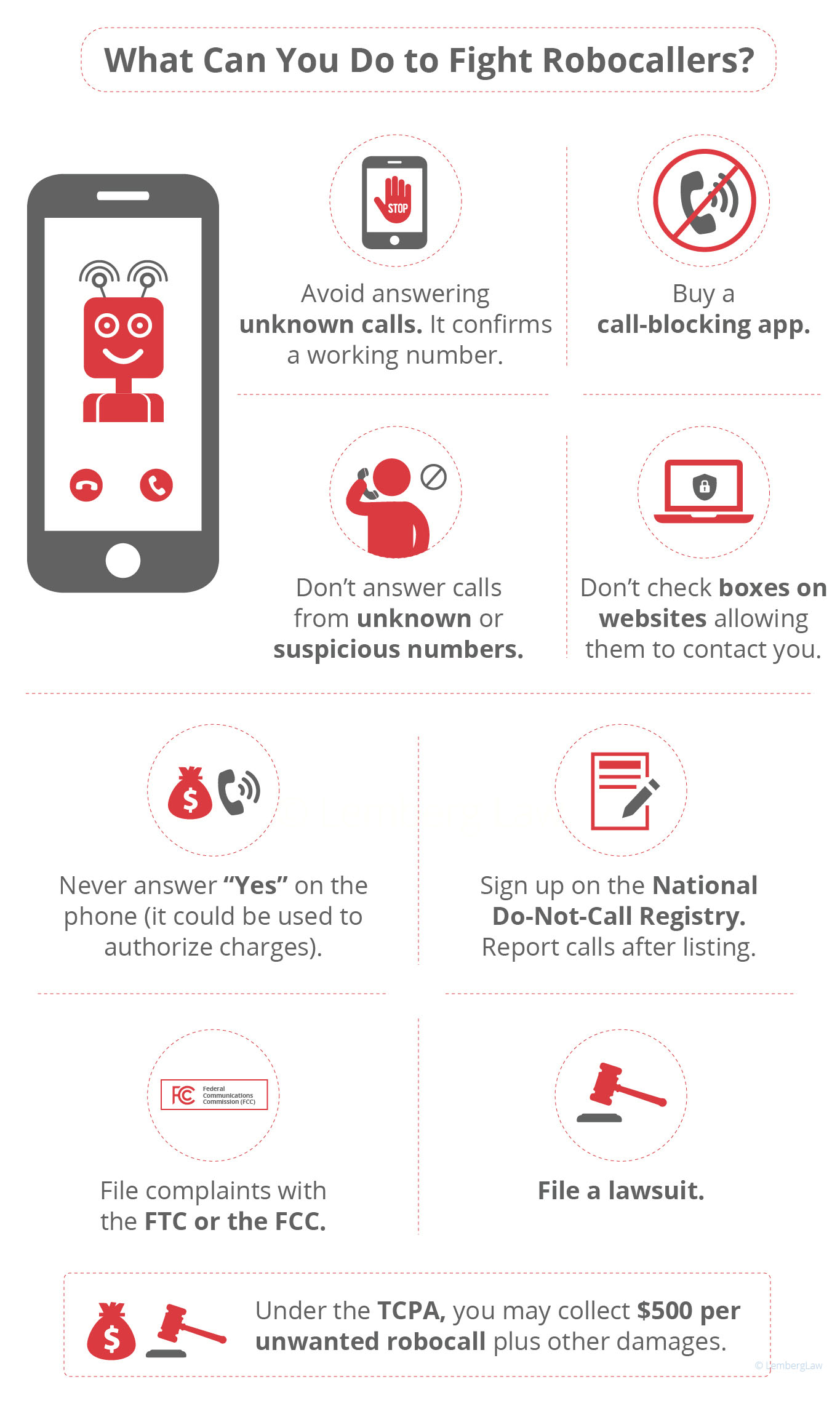

If the calls continue here are a few more things you can do:

Don’t answer the call

Experts agree that answering a robocall can help confirm that your number is active and make you a target for even more calls.

If you do find yourself answering accidentally, conventional wisdom would compel you to respond to the opt out message they present you with, but DON’T. Again, experts agree that doing so will merely verify that you have an active phone number and make you a target for more calls.

Use the Do Not Call Registry

The federal government set up the National Do Not Call Registry in 2003. List your phones on the registry. One you list your nuber, it will stay listed forever. If your number is on the registry and you still get unwanted calls, report them on donotcall.gov. This method however is becoming less effective than it used to in the past, as more and more telemarketers and spammers are failing to comply with the regulations

Ask your phone provider to block

Many providers have tools that help you stop unwanted calls. AT&T, Verizon, Sprint and T-Mobile all have tools to help you identify and block calls from scam numbers.

If any or all of the above fail, take the robocallers to court and get paid to do it. We’ll do all the work for you. Here’s how:

Sound too good to be true? The truth is, we deliver. That’s why we’ve been named the most active consumer law firms in the country. We’ve been down this road thousands of times. We know the landscape. And we can drive your case to a successful conclusion.

How it Works

When we take your case, we flag down the harassing caller. Maybe it’s a debt collection agency. It could be a company’s robocaller. It could even be a commercial spam texter. We let them know that we’ve got their number.

If the caller knows they’ve violated the law – either the Telephone Consumer Protection Act or the Fair Debt Collection Practices Act (or both) – they usually offer a monetary settlement. This can happen before the first document is ever filed in court.

If not, we go ahead and file your lawsuit. They usually come around and offer to settle. If not, though, we put our foot on the gas and litigate your case to get you the best possible result.

We’ll keep you in the loop, inform you of your options, and allow you to make the decision that’s best for you and your family.

We Deliver

The bottom line? If the calls you hate are violating the law, we’ll stop the calls and get you the justice you deserve. And, a nice chunk of money to boot.

How much? It depends. Everybody’s different. Every case is different. But the law says between $500 and $1,500 per call for TCPA violations. And maybe another $1,000 for FDCPA violations if it’s a debt collector who’s harassing you. We take a percentage for our fee, and you get the rest.

With Lemberg Law at the wheel, you’ll be able to relax. Reclaim your life. And make the harassing callers pay YOU.