- Lemberg Law

- FDCPA – Debt & Credit Complaints

- What is the FDCPA?

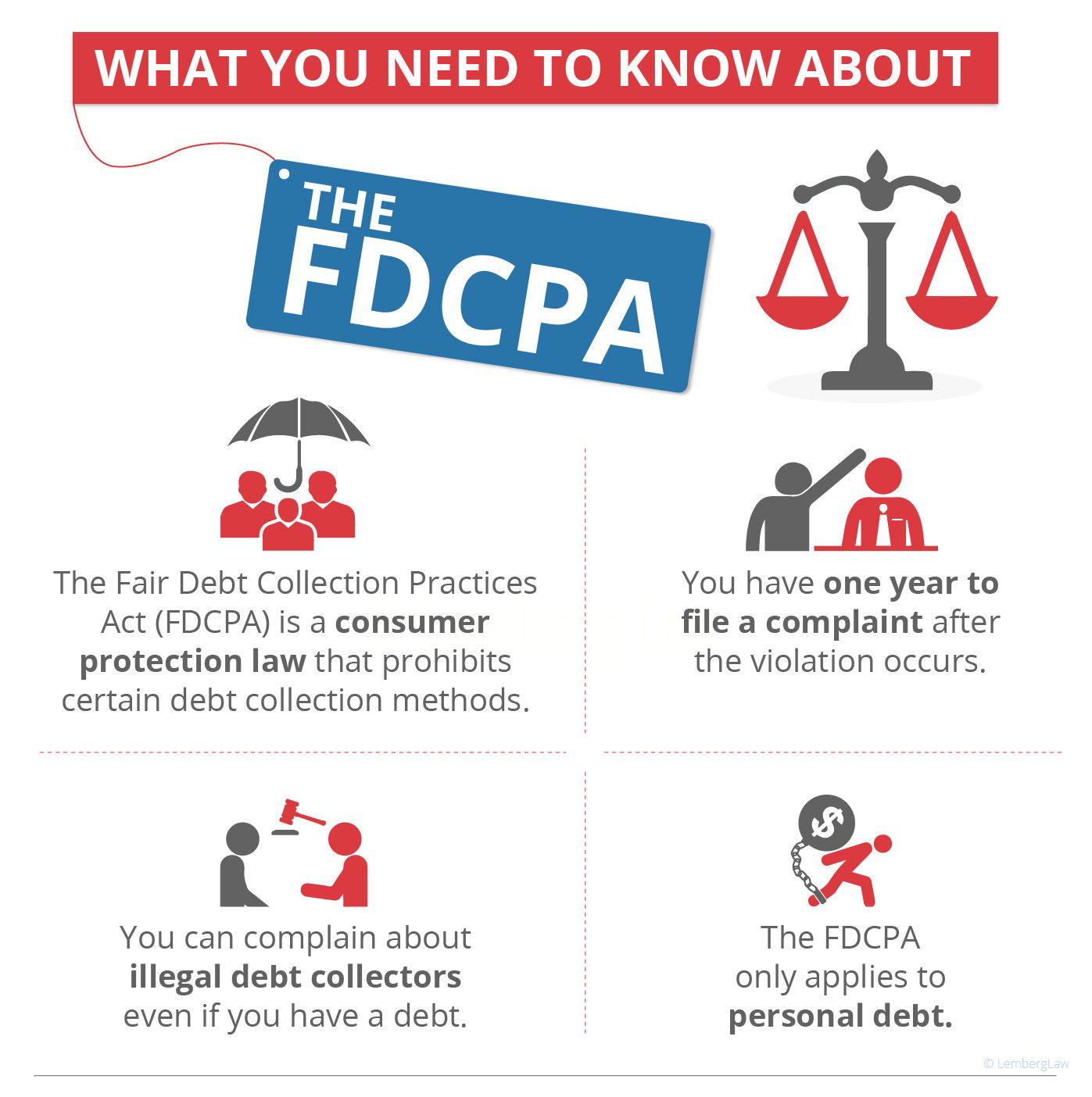

The FDCPA stands for the Fair Debt Collection Practices Act. It is a federal statute (15 U.S.C. 1692) signed into law in 1977 that is designed to rein in abusive debt collection tactics. It applies only to third-party debt collectors.

The FDCPA stands for the Fair Debt Collection Practices Act and is codified in 15 U.S.C. 1692. President Jimmy Carter signed the FDCPA into law on September 20, 1977. The law’s purpose is to rein in abusive debt collection practices and ensure that consumers retain their privacy and dignity throughout the debt collection process.

What Is A Violation Of The FDCPA?

Broadly speaking, the FDCPA law forbids debt collection agencies from harassing you, embarrassing you, threatening you, and misleading you.

Who is covered by the FDCPA?

The FDCPA protects consumers who have incurred debts, but does not apply to businesses. The Act’s prohibitions apply to third-party debt collectors, as opposed to original creditors.

The FDCPA has several different sections. They cover how debt collectors can locate consumers and how collectors can talk to others about a consumer’s debts. It also covers specific behaviors that are deemed abusive, misleading, or unfair. In addition, the FDCPA outlines actions that a debt collector is required to take, and remedies afforded a consumer if a debt collector violates the law.

How can debt collectors communicate under the FDCPA?

According to the FDCPA, a debt collector can’t contact consumers before 8:00 a.m. and after 9:00 p.m., or at a date and time known to be inconvenient. They can’t contact a consumer if they know that the consumer is represented by an attorney, and they can’t call a consumer at work if the debt collector knows that it’s against the rules for employees to receive personal phone calls. In Austin v. Great Lakes Collection Bureau, the debt collector continued to call Ms. Austin at work, even though she had told them to stop. The court ruled in her favor.

What is considered harassment under the FDCPA?

The FDCPA outlines a number of practices that it deems harassment or abuse. These include the threat or use of violence, employing obscene or profane language, calling a consumer repeatedly, and publishing a list of debts owed by consumers. In Horkey v. JVDB & Associates, Inc., for example, a debt collector phoned and told Ms. Horkey’s coworker, “Tell Amanda to stop being such a f—- b—-.” In that case, court ruled that the debt collector violated the section of the FDCPA prohibiting the use of profanity.

What is considered deception under the FDCPA?

The law outlines a number of illegal false or misleading representations. For example, a debt collector can’t lie about the amount of money owed or the legal status of a debt. They can’t pretend to be an attorney if they’re not, and they can’t threaten legal action if they don’t intend to take legal action – or aren’t capable of doing so. A debt collector is also required to tell the consumer that they are a debt collector, and that information that the consumer provides will be used for the purposes of debt collection. In Foti v. NCO Financial Systems, the court ruled that the debt collection agency violated the FDCPA when it left a vague voicemail for a consumer asking the consumer to return the call – without stating that NCO was a debt collector.

What are unfair practices under the FDCPA?

The FDCPA outlines a number of practices that it deems unfair. These include depositing post-dated checks, threatening to take property that isn’t secured by the debt, communicating via postcard, and sending a letter that includes a reference to debt collection on the envelope.

What does the FDCPA say about debt validation?

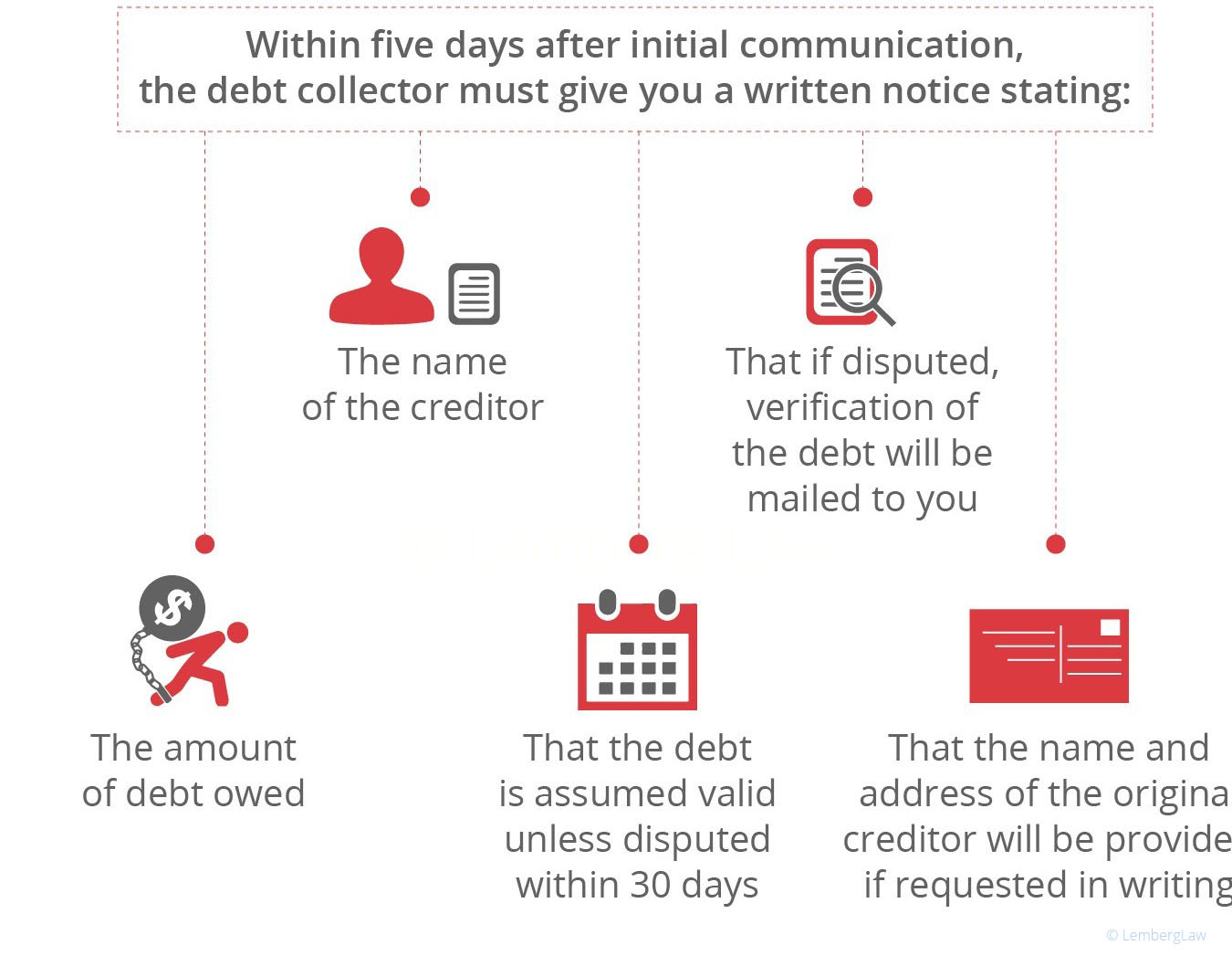

The law says that the debt collector must send a consumer a written notice within five days of first contacting the consumer. The notice must state:

- the creditor’s name

- the amount owed

It must also let the consumer know that they have 30 days in which to dispute the debt, and that, if the debt is disputed, the debt collection agency must verify the debt.

What penalties exist for debt collectors that violate the FDCPA?

The FDCPA allows consumers to recover up to $1,000 from collectors that violate the law. The FDCPA and related regulations give the Federal Trade Commission the authority to bring enforcement actions against debt collection agencies that violate the FDCPA. While the Consumer Financial Protection Bureau tracks complaints against debt collectors, neither the FTC or the CFPB is equipped to bring actions on behalf of individual consumers. That’s why the FDCPA has what’s called a fee-shifting provision that says that lawbreaking debt collection agencies must pay consumers’ legal fees. In other words, it doesn’t cost consumers a penny to file suit against debt collection agencies that act in violation of the FDCPA.

Want more answers?

Your rights, illegal collection, and abuses to watch.

Connect with a debt harassment legal expert.

Call 855-301-2100, or Fill out our form and we'll call you. No cost!

More about the FDCPA

Definition of a debt collector

The FDCPA defines debt collectors as those in the business of collecting debts, including attorneys, who use such interstate devices as phones, internet, and mail.

The FDCPA regulates activities by third-party debt collectors, but not collection activities taken by employees of original creditors. For example, a bill collector employed by a bank is not covered under the FDCPA, but a debt collection agency hired by the bank to collect the debt must abide by the FDCPA.

In 2017, the U.S. Supreme Court ruled that debt buyers, who typically purchase old, charged-off debt for pennies on the dollar, are not debt collectors under the FDCPA. (See Henson v Santander.)

Definition of a consumer

The FDCPA defines a consumer as a natural person. This means that the FDCPA applies to personal debt, but not to business debt.

How debt collectors can find you

A debt collector may ask a third party – like a friend, family member, or your employer – for your address, phone number, and place of employment. A debt collector is required to identify themself and, only if requested, identify their employer. A debt collector may not:

- Tell the third party that you owe a debt.

- Contact the third party more than once (unless requested to do so.

- Communicate by postcard.

- Send written communication that indicates they’re collecting a debt.

- Talk to a third party if you’re represented by an attorney.

How debt collectors can communicate with you

The FDCPA regulates how and when a debt collector can communicate with you. It prohibits a debt collection agency from:

- Mailing a postcard to you

- Mailing you an envelope that indicates it is from a debt collector

- Contacting you if it knows you have an attorney

- Suggesting a meeting at a place known to be inconvenient for you

- Contacting you before 8:00 a.m. or after 9:00 p.m. in your time zone

- Calling your workplace after you have told them not to or that your employer doesn’t allow personal calls

- Contacting you after you have sent them a written notice telling them not to; there are two exceptions to this prohibition

Protection from harassment or abuse

The FDCPA’s primary focus is preventing debt collector harassment. Under the law, a debt collector cannot:

- Use threats of violence or other criminal means to harm you in any way

- Use profane or abusive language

- Publish your name alleging that you refuse to pay a debt

- Repeatedly call you or talk to you in order to annoy and harass you

- Call without disclosing their identity

Protection from false or misleading information

The FDCPA also seeks to prevent debt collectors from lying to you or trying to trick you. For example, a debt collector cannot:

- Tell you that they are an attorney if they are not an attorney

- Lead you to believe that they are a government representative, including by wearing a uniform or showing you a badge

- Give you misinformation about the type, amount, or legal status of the debt

- Tell you that, if you don’t pay the debt, you’ll be arrested or sent to jail

- Threaten that they’ll take your property or garnish your wages if you don’t pay the debt

- Threaten to sue you if they don’t intend to do so

- Lie about being a debt collector or lie about the company they work for

- Fail to identify themself as a debt collector and to state that all information will be used to collect the debt

- Claim that they’re from a credit bureau

Protection from unfair practices

“Unfair practices” seems like a vague concept, but the FDCPA provides a laundry list of debt collection practices that it deems unfair. For example, a debt collector cannot:

- Collect money that isn’t part of the original credit agreement, such as interest, fees, or expenses

- Accept a check postdated by more than five days without providing you with a written notice three days prior to the collection agency deposit it

- Threaten you with criminal prosecution unless you give them a postdated check

- Deposit or threaten to deposit a postdated check prior to the date on the check

- Threaten to take your property unless it’s used as collateral

Notices required from a debt collector

The FDCPA lays out specific information about what a debt collection agency must do in order to validate your debt. For example, within five days after initially contacting you, the debt collector must send you a written notice stating:

- The amount of debt

- The name of the creditor

- That you have 30 days to dispute the debt; if not, they will assume the debt is valid

- That if you dispute the debt, the debt collection agency will send you verification of the debt

- That if you request it in writing, the debt collector will provide you with the name and address of the original creditor

If you dispute the debt, the FDCPA prohibits the debt collection agency from contacting you again until you receive the name and address of the original creditor.

Rules about multiple debts

Under the FDCPA, if a debt collection agency is trying to collect on multiple debts that you owe, you can make a payment on one of those debts. The debt collection agency must apply the payment to the debt you specified. It cannot apply your payment to a different or to a disputed debt.

Legal actions by debt collectors

The FDCPA doesn’t authorize any legal actions by debt collection agencies. It does say that, if a debt collection agency files a lawsuit regarding real estate, it has to be filed where the property is located. It also outlines that, if a debt collection agency sues you, it has to file the lawsuit in the jurisdiction where you live or in the jurisdiction where you signed the contract that generated the debt.

Using deceptive forms

The FDCPA prohibits debt collectors from creating or giving you a form that leads you to believe that someone else is involved in the debt collection activity, such as a family member or the government.

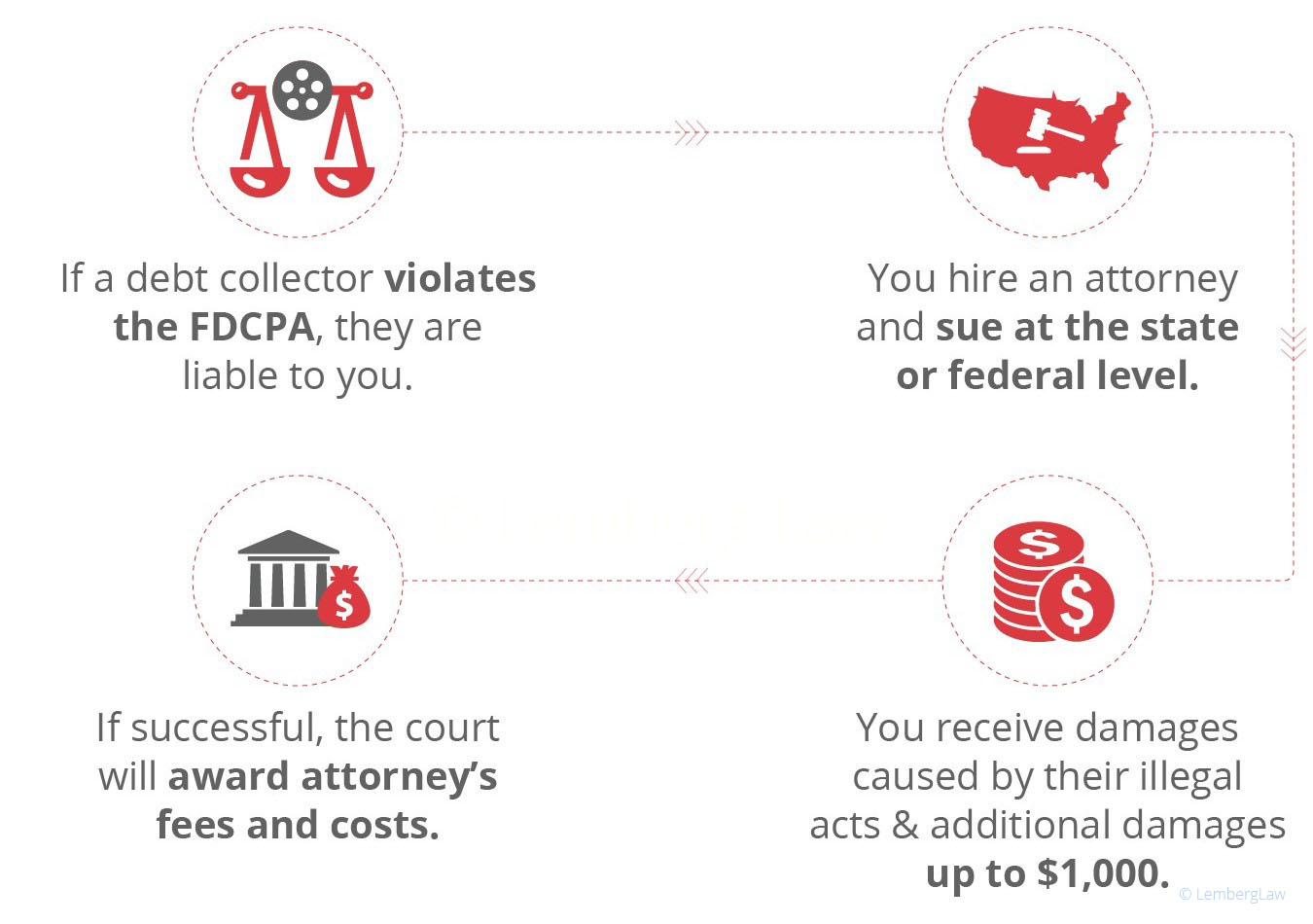

Penalties if debt collectors violate the FDCPA

If a debt collector violates the FDCPA, you can sue the debt collection agency in state or federal court. The FDCPA allows you to recover actual damages, statutory damages up to $1,000, court costs, and attorney fees. This fee-shifting provision makes it feasible for individual consumers to assert their rights and fight against debt collection abuse.

If you are a named plaintiff in a class action lawsuit, in addition to these damages you are entitled to an amount the court allows for all members of the class, not to exceed either $500,000 or one percent of the debt collection agency’s net worth.

The FDCPA’s relationship to state laws

Congress clearly wanted the FDCPA to harmonize with state consumer protection laws. It specifically provides that debt collectors remain subject to all state laws unless they are inconsistent with the FDCPA. This inconsistency exists only if you are state protections are less than the protections afforded by the FDCPA.

Case citations: Henson vs. Santander Consumer USA Inc., 582 U.S. (2017); Austin v. Great Lakes Collection Bureau, 834 F. Supp. 557 (D. Conn. 1993); Horkey v. JVDB & Associates, Inc., 179 F. Supp. 2d 861 (N.D. Ill. 2002); Foti v. NCO Financial Systems, Inc., 424 F. Supp. 2d 643 (S.D.N.Y. 2006)

Want more answers?

Your rights, illegal collection, and abuses to watch.

Connect with a debt harassment legal expert.

Call 855-301-2100, or Fill out our form and we'll call you. No cost!