- Lemberg Law

- FDCPA – Debt & Credit Complaints

- Debt Collection FAQ’s

- How to answer a summons for debt collection

If you are among the one out of three Americans who owe a debt held by a private debt collection agency, you know it can put a shadow over your life when they try to collect, and you can’t pay.

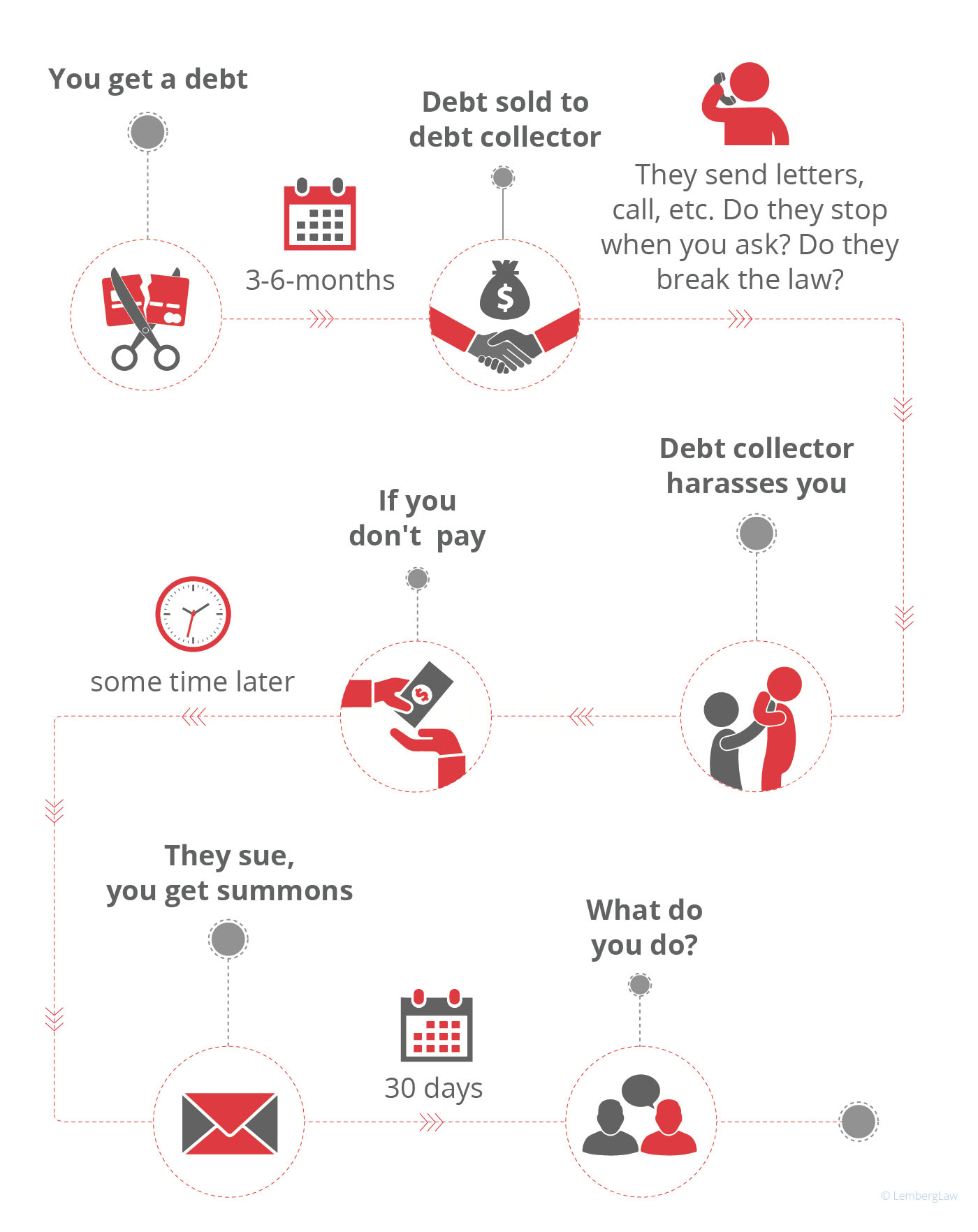

When you can’t pay a debt, creditors will send notices and may charge interest and late fees. If you still don’t pay, you may receive phone calls and email from the company as well as more letters. Eventually, usually somewhere between three to six months of nonpayment, the company may sell your debt to a debt collection agency which is likely to pursue payment much more aggressively. After a time, the collection agency is likely to file a complaint and mail you a summons to appear in court. The debt collection summons will typically say that you must file a response within 30 days. Now what?

What Happens if You Ignore the Debt Collection Summons

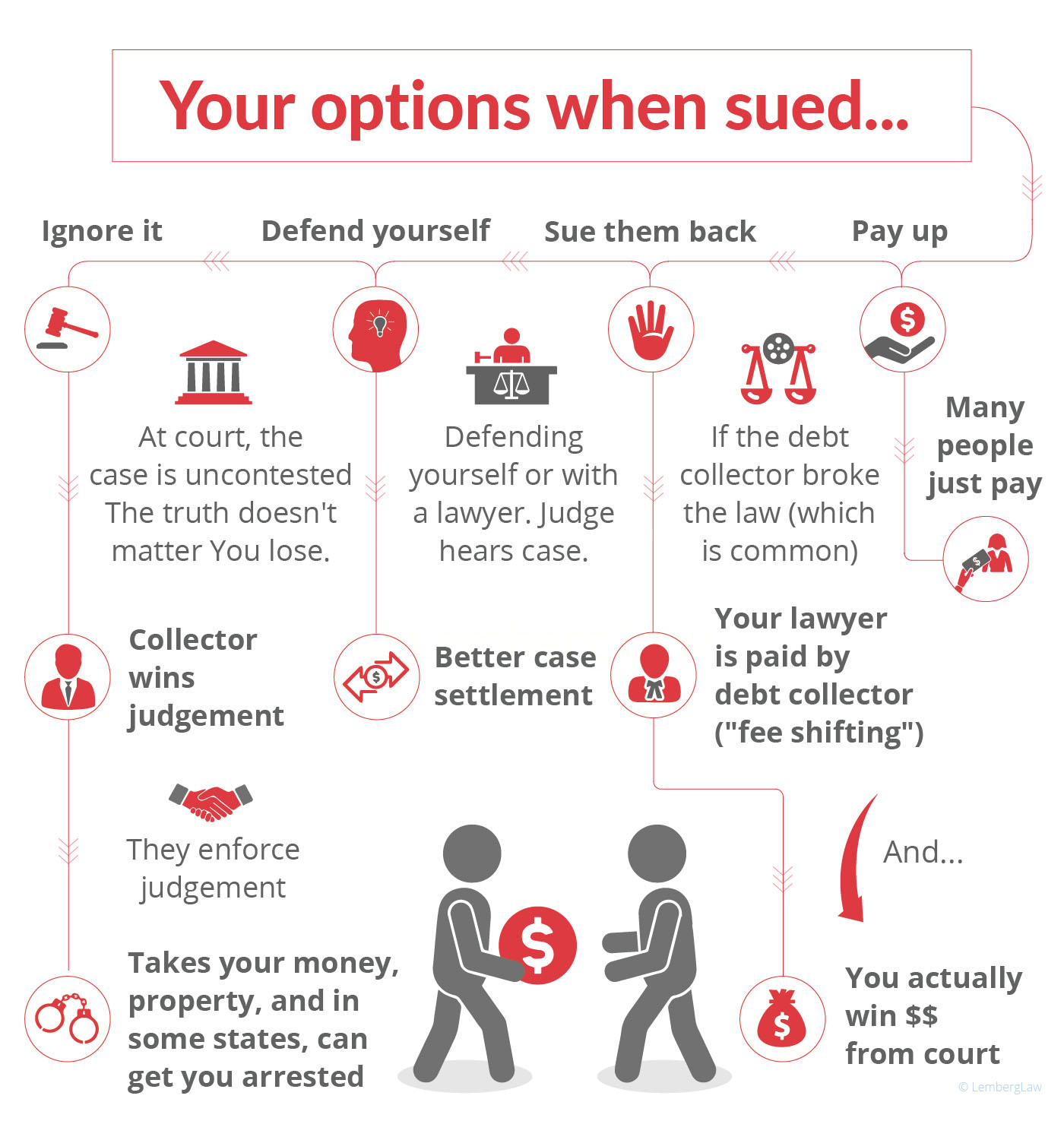

When most people receive a summons to appear in court because of a debt, they ignore it because the problem may seem insurmountable. They may hope that the debt collector will give up and go away. Nothing could be further than the truth. When a person receives a debt summons and doesn’t file a response or attend the hearing, they play right into the hands of the debt collector.

If a person does not respond to the complaint within the time allotted or show up in court on the appointed day, it’s almost a given that the court will rule in favor of the debt collection agency. 90% of cases are decided in favor of collection agencies to a large extent because most cases go uncontested. Debt collection agencies hope you do one of two things when you receive their summons: panic and pay the debt or panic and do nothing. Why? If you answer the complaint and show up in court, there is a chance the debt collection agency will lose, or that they will only get a judgment for part of the amount asked. If you go to court, your lawyer may even be able to show that the collection agency acted illegally and owes you money damages.

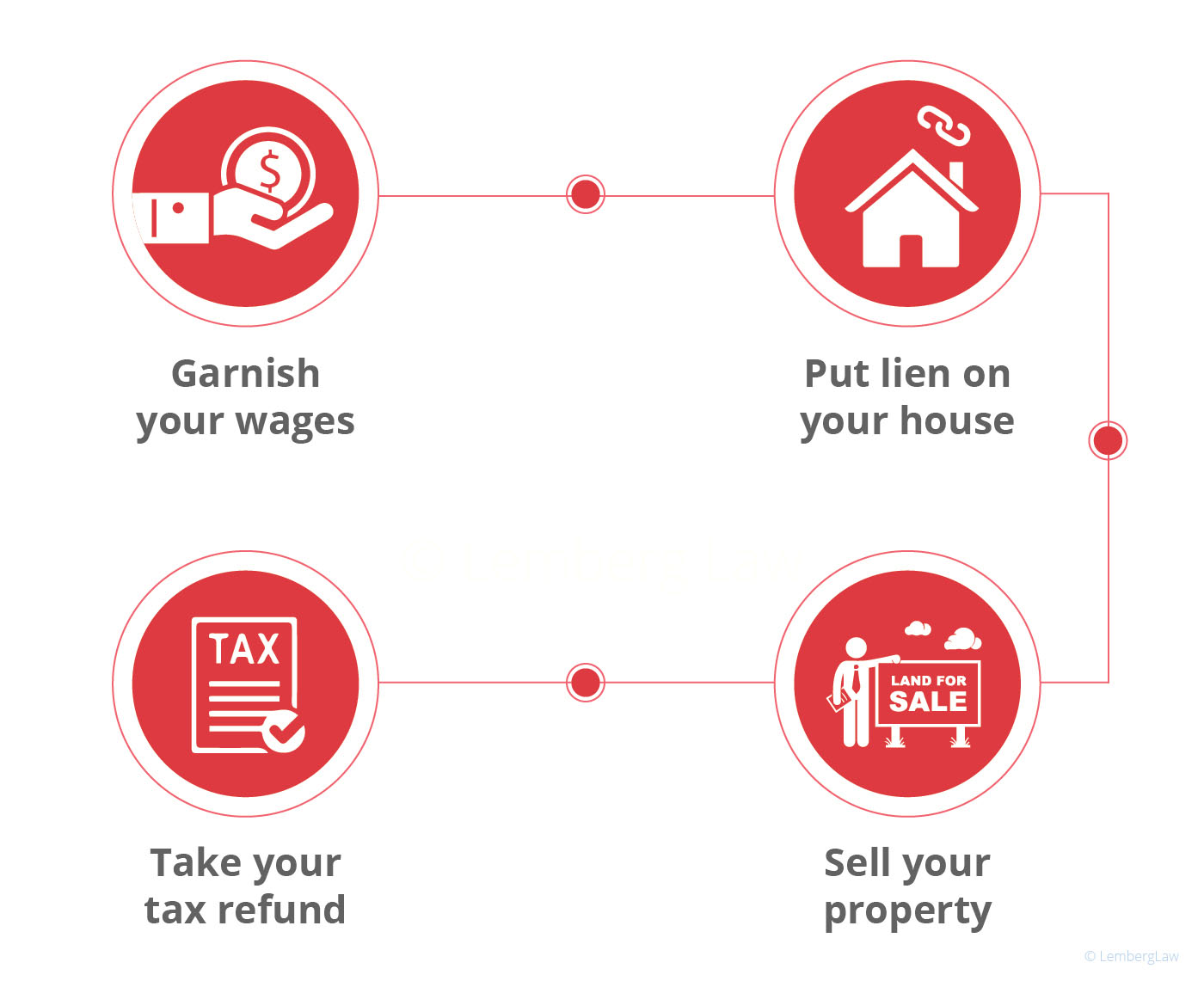

However, once a collection agency gets a judgment against you because you didn’t show up for the hearing, they can now proceed to enforce the judgment through garnishing your wages or seizing your property. It does not matter if you do not really owe as much as the agency claims, had your debts discharged in bankruptcy or never owed the debt at all. If you are not there to defend yourself, the court will likely grant the debt collection agency a judgment in the full amount named in their complaint.

Taking your money or property: Wage Garnishment and Property Seizure

Here are some of the ways a debt collection agency can enforce a judgment.

- Request the sheriff to serve wage garnishment notification on your employer, so your employer must withhold a designated amount for the creditor every pay period

- File a lien on your real estate, which must be paid when you sell or refinance your property before the deal can be finalized. The creditor can also execute on the lien immediately by having the sheriff seize your real property and arrange a public sale. Certain real property may be exempt, and this varies state to state.

- Levy on your personal property through the local sheriff, which means the sheriff will take the property and sell it at public auction. Once again, some property will be exempt.

- Get an assignment order for property that is not subject to levy such as tax refunds.

Your attorney may be able to halt these proceedings in various ways such as negotiating a settlement or by calling legal restrictions into play (for example, a debtor’s wages may not be garnished again if they are already being garnished), but you are in a much worse situation once a creditor has a judgment against you vs. acting immediately upon receiving the summons.

Getting you arrested: Arrest Warrant for Contempt

Once a debt collection agency has that judgment, in order to aid their collection process, they can request the court fora “judgment debtor examination.” This is a process where the creditor can interrogate you about your finances. If you do not appear at the initial hearing for which you received the summons or for the judgment debtor examination, in 44 states the creditor can petition the civil court judge to issue an arrest warrant.

This is true even though debtors’ prison was outlawed in the United States in 1833. The 1983 the Supreme Court decision in Bearden vs. Georgia will not help either, though it held that putting debtors in jail is unconstitutional under the Fourteenth Amendment. This is because technically, you would not be imprisoned due to the debt itself but rather for contempt of court for failure to appear. You may not even know about the warrant until you are stopped for a minor traffic violation and the outstanding warrant lands you in jail. It doesn’t matter how little you owe, or even if you actually owe the debt at all.

You may think this is nothing to worry about, because you don’t owe much, but an ACLU report that examined the incarceration of people due to debt found that the amounts involved in warrants were as low as $28. The average consumer debt that private collection agencies hold is $1,300

The Law Protects You Against Unethical Creditors

Both state and federal law give you protections against creditors and debt collection agencies, and the time to exercise these is before judgment is rendered against you. Many consumers are too intimidated to attempt negotiating with debt collection agencies or don’t know what such an agency is likely to accept. Before you get a summons or immediately thereafter, it would be wise to consider consulting with an experienced debt collection defense lawyer. They can negotiate with your creditors and advise you of your rights. But debt collection defense attorneys can do more than that.

The federal Fair Debt Collection Practices (FDCPA) and various state laws offer you protection from unethical debt collection practices. For example, there are legal restrictions against debt collectors harassing you, lying to you, embarrassing you and threatening you. Even when you owe a debt, if a debt collector violates your rights, you can sue them for damages you suffered such as lost wages and medical bills if those apply. Even if you can’t prove damages, you could still be awarded up to $1,000 plus attorney’s fees and court costs, which means you will not pay your attorney yourself. If the debt collector violated the rights of many people, you may be able to join a class action suit where the group can be awarded damages up to $500,000 or 1% of the debt collector’s net worth, whichever amount is lower.Here’s where you can read more about prohibitions against unethical actions by debt collectors and the protections offered by the FDCPA.

How to Get Help When You Receive a Debt Collection Summons

At Lemberg Law, we will help you to fight debt collectors with no money upfront. We will never send you a bill, and we only get paid if we win or settle your case. We understand this is a difficult time, but that does not mean you should not have the best possible legal representation on your side. If you justly owe a debt, we will negotiate the best possible deal for you that includes our fees, so you still come out ahead. If you do not owe the debt or only part of it, we will fight for you in court.

If a debt collection agency has violated the law, we will sue them for money damages on your behalf. Should the court finds them guilty, the court will order the agency to pay our fees and your court costs. This is called fee shifting. If you do not win your complaint for the debt collection agency’s illegal behavior, you still do not have to pay us. Either way, our services are free to you.

Debt collection agencies collect debts for a living, and they know the ins and outs of the court process. If you get a debt collection summons, you have a very limited time to respond. Don’t hesitate to call us for a free consultation so we can stand up for you and protect your rights. There is no reason to try to fight debt collection agencies or face the courts on your own, when you can hire Lemberg Law attorneys to represent you for free.