- Lemberg Law

- 3 Shocking CFPB Consumer Complaint Trends

The Consumer Financial Protection Bureau (CFPB) was created in the wake of the 2008 financial crisis. Its mission is to ensure that consumers are on a level playing field when it comes to financial markets and products. The CFPB develops consumer education initiatives, fields consumer complaints, and sues companies that engage in particularly egregious behavior.

Lemberg Law is particularly interested in the complaint data collected by the CFPB, as it provides insights into irresponsible – and sometimes predatory – behavior by the financial services industry. Here are three shocking consumer complaint trends revealed by the firm’s deep dive into CFPB data.

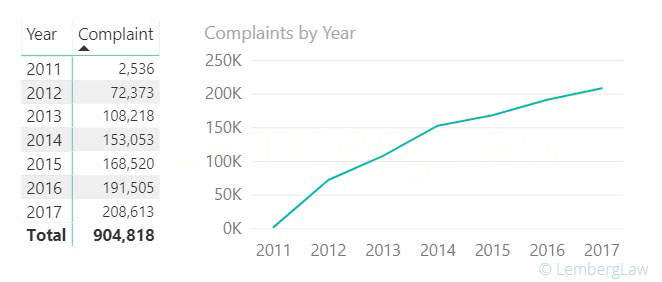

1. Number of Complaints Skyrockets

The sheer number of consumer complaints has steadily increased since the CFPB’s inception, which followed the enactment of 2010’s Dodd-Frank Wall Street Reform and Consumer Protection Act. The CFPB initially took over the Federal Trade Commission’s complaint tracking function in 2011, and launched its Consumer Complaint Database in 2012. In mid-2011, the Bureau began accepting complaints about credit cards, and in December 2011 started tracking mortgage complaints. Following that, in March 2012, the CFPB welcomed complaints about bank products and services, and began taking complaints about debt collection agencies in July 2013.

Since 2013, the number of complaints has continued to climb, likely a sign that consumers are increasingly asserting their rights.

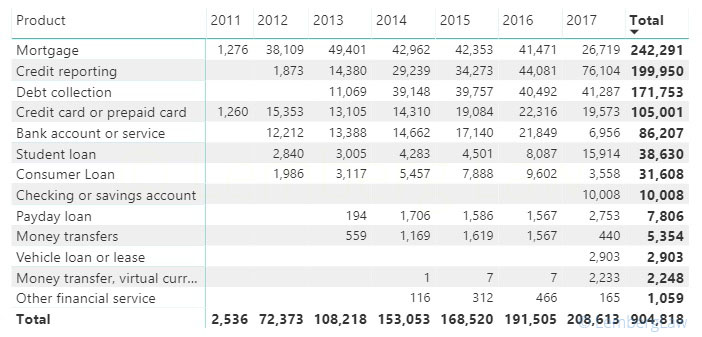

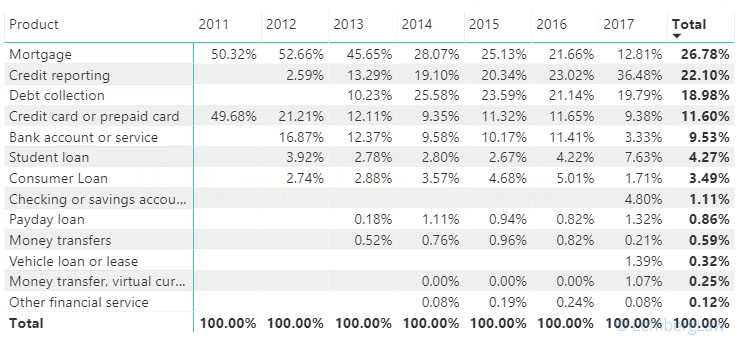

2. Credit Reporting and Student Loan Complaints on Track to Double

Consumers file CFPB complaints about many different types of financial products. Examining the volume of complaints, it’s clear that mortgage issues are by far the most problematic of all financial products, with credit reporting issues ranking second. It’s notable that the pace of 2017 credit reporting complaints is almost double that of 2016. The most frequent credit reporting complaint? That there are errors on the person’s credit report. Debt collection complaints are most frequently filed by consumers protesting attempts to collect a debt that they did not owe.

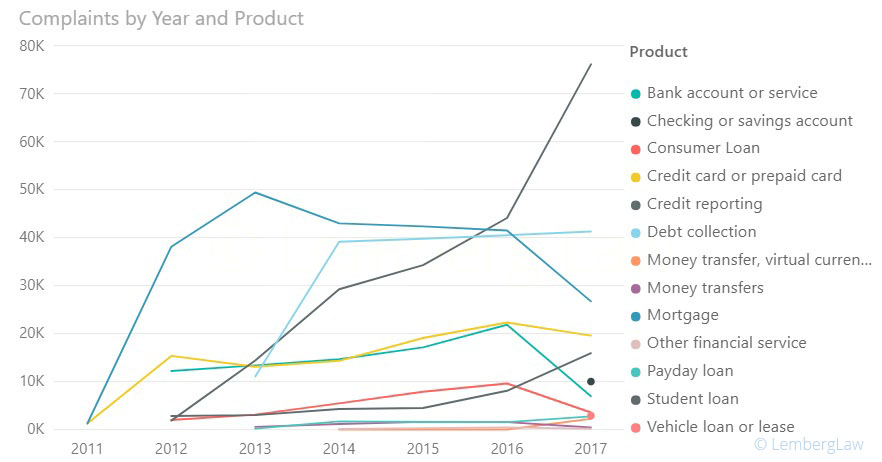

While the number of complaints about debt collection and credit cards has remained relatively flat, the number of complaints about student loans has skyrocketed, and is on pace to double the number of complaints filed in 2016. This could be related to a specific company, Navient, which is a student loan servicing giant that the CFPB and state attorneys general sued in January 2017 for allegedly failing to process payments correctly, providing incorrect payment information, and not responding to borrower complaints.

It appears that mortgage and credit reporting complaints will soon comprise half of all CFPB consumer complaints.

Charting complaint trends visualizes the startling surge in credit reporting complaints.

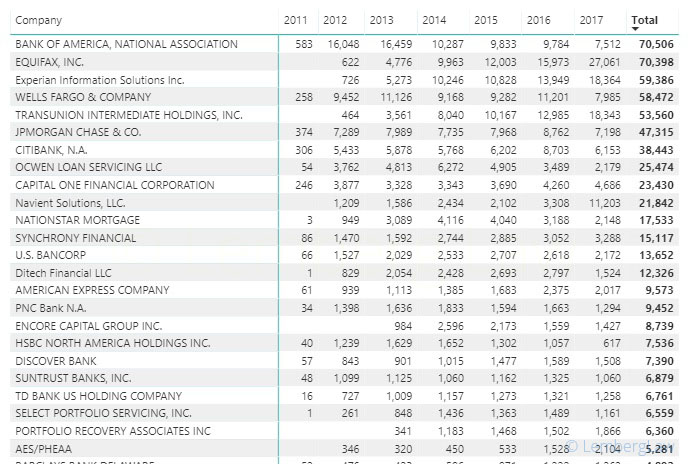

3. Bank of America Most Complained-About Company

The banking behemoth Bank of America is the leader in CFPB complaints. Given the giant has its proverbial fingers in virtually every segment of the financial services pie, that may not be a surprise. What might come as a shock, though, is that the number of complaints against Bank of America has steadily decreased since 2014. This may be a signal that the financial services company has gotten the message. The rate of complaints against B of A is now aligned with that of other big banks like Wells Fargo and JPMorgan Chase.

In contrast, Equifax, Experian, and TransUnion – the big three credit reporting agencies – have seen complaints surge over the past year. Similarly, Navient Solutions – the student loan servicer – has accrued almost four times the complaints it received in 2016.

CFPB data is also revealing when it comes to individual types of financial products. For example, among debt collection complaints, Bank of America still ranks first over time, though it is followed closely by I.C. System – the debt collection agency that has raked in the most complaints during 2017.

Those wishing to slice and dice CFPB complaint data can access the database at https://www.consumerfinance.gov/data-research/consumer-complaints/